Retirement Investing That Follows Your Morals and Beliefs.

One of the biggest fears that people face in retirement is running out of money. And at one time or another, almost everybody, including retirees, faces a moral money dilemma too. That is, most people know that they need to save money for retirement. But they don’t want the money they save to support businesses or business practices that go against their beliefs or principles. The good news is that with the right information and direction, you do not have to sacrifice your values to have a secure retirement.

What is your view?

One of the primary ways that Americans hold their wealth for retirement is in investment accounts. Those investment accounts are made up of some sort of ownership of capital. That ownership may be in the form of stocks, bonds, some combination, or variation.

When you invest money in a company’s stock or bonds, you hope to make a profit. But if you are like most people, you don’t want to support companies that go against your morals and beliefs. At this point, you probably have one of three views.

- You agree 100% and never support companies that violate your morals or beliefs.

- You agree, but you’re not sure how to match your morals and beliefs with your money.

- You don’t care, money is money.

Matching your money to your morals and beliefs only takes three steps.

- Clarify your investment beliefs

- Determine which investment process matches your beliefs

- Set up an account and monitor the process

What’s this going to cost?

It may seem as if this next point is getting ahead of ourselves. But this aspect will save you time. Let’s assume that you don’t want to invest in something that violates your principles. What is it going to cost to match your morals with your money? The good news is that principle-based investing does not need to cost any more than any other type of investing. One exception is when using impact investing, where the outcome is the most critical aspect. But for most principle-based investing, there is no difference in cost.

I will describe several alternatives. But in the end, I am going to share with you what I believe is the best solution for principle-based investing. So, lets put the solution and its cost front and center. The solution I often recommend for principle-based investing is called direct Indexing. This strategy gives investors the ability to invest directly into indices without going through a mutual fund or ETF structure.

Specific cost

The direct indexing strategy I offer to clients is based on a fee-only cost. The cost of the index analytics is 0.40% of assets annually. In addition, my management fee ranges from 1% for smaller accounts to 0.40% for larger accounts. If index stock trades are made within set time-frames, there is no trading fee or commission. There are more details of the cost at the end of this article. Complete details are available for those that are interested from me directly. You should read all the obligatory disclosures before investing.

Step 1. Here is how to start

The good news is that you can select how your retirement savings are utilized until you want to spend it. The first step is to define how you do or do not want to have your retirement savings to be invested. There are several definitions for principle-based investing. Two of the most common references are ESG and BRI. ESG is environmental, social, and governance. BRI is biblically responsible investing. But there are also Sustainable Investing (SI), Responsible Investing (RI), and Socially Responsible Investing (SRI).

What is the color blue?

Determining which definition fits you is kind of like defining a color. If you had to define the color of blue, how would you do it? You could say blue is like the sky. While another person could say, blue is the color of the ocean. And yet another could say blue is the color of a sapphire. Defining principle-based investing is like explaining the color blue. People describe a color based on their experiences, understanding, interpretations, and beliefs. Like the descriptions of colors, there are so many variations on principle-based investing that it is impossible to have only one definition. How each theme is defined can vary from person to person.

Freedom of belief is powerful!

The freedom to think and believe independently is a dominant part of human nature. That is why moral and belief-based investing has such a broad appeal to people. The investment industry has taken notice. Financial institutions have attempted to broadly address principle-based investing by monitoring, rating, and ranking investments based on what they see as fitting people’s values. Therein lies a problem. Can a large corporation really tell you what values are important?

The obvious answer for most people is no. But, the finance industry does do an excellent job of monitoring, researching, and reporting. If you know what factors to consider, then you can make a choice whether that factor is important to you.

To give you a better understanding of what to consider, let us take a closer look at some of the issues that you may face when choosing ESG investments. We can do this by looking at examples of environmental, social, and governance factors.

Environmental

As you might imagine, the spectrum of environmental issues is broad. If environmental issues are important to you, you probably want to avoid owning the stock of companies that have a history of polluting.

Electric automobiles are touted as a solution to air pollution. That sentiment has been reinforced by the coronavirus pandemic. With fewer people driving, air quality in many locations around the world has improved.

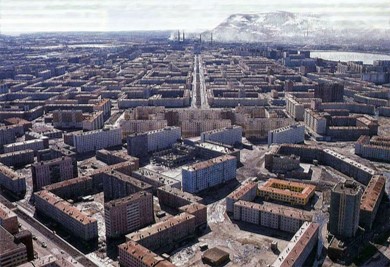

Large batteries are essential to the manufacturing of electric cars. A significant component of electric car batteries is nickel. One of the largest producers of nickel is a Russian company called Norilsk Nickel Mining & Metallurgical Company (NILSY). Norilsk Nickel has a history of being one of the worst environmental polluters in the world. 1

The most recent incident began on about May 29, 2020, in Russia’s Arctic region. One of Norilsk Nickel’s storage facilities leaked about 21,000 tons of diesel fuel into the Ambarnaya River and surrounding area. The spill is attributed to the melting of the permafrost where the storage facility is located. 2

So, an accident like this brings up a host of questions related to environmental conservation. First, why did Norilsk Nickel not build a better containment area? Second, if you know that Norilsk Nickel has a historical disregard for the environment, would you buy stocks of companies that Norilsk Nickel sells its products to? But what if the companies that they sell to are environmentally friendly such as some electric car makers?

Not to be too geeky, but related third party pollution is called Scope 3 Emissions. Some companies report Scope 3 Emissions, but many do not because of the difficulty of tracking them. From an investor’s standpoint, the use of monitoring or rating companies such as S&P or MSCI is immensely helpful because of their depth of research.

Social

The social aspect of publicly owned companies is broad as well. How companies respond to gender, race, and religious issues are all covered under the heading of social responsibility. Since the death of George Floyd, race is at the forefront of the social problems for all companies. How race issues should be addressed is still being debated. Suppose that race is a social issue that you want to consider before buying a company’s stock. It would benefit you to look beyond the company’s propaganda.

A good example is Nike (NKE). On September 3, 2018, Nike began an ad campaign that supported Colin Kaepernick’s protest against racial injustice. So, you may think that Nike would be a great company to invest in if social injustices are important to you.3

Supporting Colin Kaepernick was a massive boost for their brand. Nike has also launched its “Don’t Do It” ad campaign in the wake of recent racial unrest. Plus, the company has pledged $40 million to black community organizations over the next four years. 4 Note, this is $40 million from a company that is worth over $32 billion.

A closer inside look shows that Nike falls short of an internal qualitative and quantitative approach to diversity within their own organization. Based on data available from Nike and reported by MSCI, their general workforce is 44% white, 22% black, 19% Latino/Hispanic, and 9% Asian. When it comes to management and upper management, their diversity is 76% are white, 6% black, 4% Latino/Hispanic, and 9% Asian. 5 It’s assumed that the remaining percentages are other races.

Don’t take me wrong, Nike is making a notable contribution to furthering racial equality. However, they are making a significant profit by fostering their own brand.

For balance, look at a company like Cisco Systems and what they have done to further diversity. Like many other companies, Cisco has pledged financial support to help further racial diversity. June 1, 2020, Cisco Systems promised to donate $5 million for charities fighting racism and discrimination.6 But long before that, in 2016, Cisco Systems launched a program called the Diverse Representation Framework. The plan was an internal initiative to foster diversity within the company.7 Forty-eight percent of the company is made up of minorities, with 38% of front-line managers being minorities. 8

But the purpose of this information is not to endorse or degrade any company’s efforts. The purpose of this information is to give you the knowledge that you need to make decisions on whether you want companies like Nike or Cisco Systems in your investment portfolio.

Governance

Governance of a company is an aspect that is easily overlooked. That is, it is easily ignored until something goes wrong. The recent collapse of Wirecard is a notable example. Wirecard has gone from tech superstar company to bankruptcy within June 2020. The debacle has a long tale leading up to a quick fall from grace. In a nutshell, accounting firm KPMG audited the company’s finances and could not account for about 2 billion dollars. The complete timeline is detailed in The Financial Times that is referenced in the footnotes.9 As shocking as this loss is, how does knowing about Wirecard help individual investors? The answer is monitoring the “G” in ESG.

Here is what should have been monitored. Wirecard had highly unusual growth. They had eighteen consecutive quarters of positive growth. That type of growth never happens at companies like Wirecard and should have been questioned. Markus Braun, the CEO of the company, was with the company since 2002 and was the largest shareholder in the company. There was little outside oversight of the company, and Mr. Braun’s authority was rarely questioned. 10

Wirecard had a supervisory board that is supposed to oversee the company. The supervisory board was small for the size of Wirecard. The company did not have an audit committee from its beginning in 2002 until 2019. Plus, the supervisory board only had six members. The average company, similar to Wirecard’s size in Germany, has fourteen members. Mr. Braun served as the CEO and chief technology officer and controlled the activities of the understaffed supervisory board. There was not enough staff to oversee the company’s growth and operations. 10

So how can the average investor know if companies like Wirecard have the potential for fraud? The use of outside companies like MSCI is valuable. Before the problems in June, MSCI had flagged Wirecard as a company with problems. MSCI had indicated that Wirecard did not have the risk management expertise necessary in its supervisory board. MSCI had also cautioned about the lack of an industry expert on its audit committee.10 Had an investor followed MSCI’s guidance, they might have been able to avoid or at least diversify away some of the company’s risk.

Using newfound knowledge

Knowledge is sometimes a curse. If you didn’t know something, it’s easy to be oblivious to the issue. However, once you know about a problem, it is hard to ignore. But, most people don’t want to be ignorant of how their money is used. Here are six general strategies for using ESG. These strategies can be adapted to other social investing themes too.

Step 2. Determine which investment process matches your beliefs

Here are the six most common methods used to match a person’s beliefs and morals to their preferred method of principle-based investing

- Positive ESG investing – This is a best-in-class strategy that only includes investments that meet your specific investment criteria. For example, you may want to only invest in biblically responsible companies.

- Negative ESG investing – This is an exclusionary screening strategy that filters out investments with specific criteria. For example, you may want to exclude companies for animal cruelty.

- ESG integration investing – This strategy takes more of a holistic approach. It focuses on an investment’s overall profile and pro-social responsibility. For example, an electric car maker could be significantly reducing carbon emissions. That effort may be greater than the environmental damage that its nickel producer is causing. Remember that even if you don’t agree, this is just an example of the concept.

- Impact investing – This strategy selects investments that have the potential to produce positive social or environmental impact along with financial returns. Financial gain is not the primary objective of impact investing. Investments that focus on wind power could be considered impact investments.

- Sustainable investing – This strategy depends on selecting investments that create a sustainable product, resource, or practice. Examples are companies that are creating carbon neutrality, energy conservation, water conservation, natural resource renewability, or renewable technology.

- General screening parameters – this is a strategy used by companies like Morningstar Research. Morningstar ranks companies on a five-level scale. Accordingly, each level is given a globe symbol. One globe is considered a poor ESG investment. Conversely, five globes are regarded as an excellent ESG investment.

Other Socially Responsible Investing Criteria

There are a broad range of Socially Responsible Investing criteria. For example, a specific lifestyle investment strategy is veganism. Vegan investing uses negative and positive screening in the investment selection process. Vegan investing is investing in companies that avoid animal-based or related products. Plus, the strategy focuses on plant-based products and/or animal cruelty-free principles.

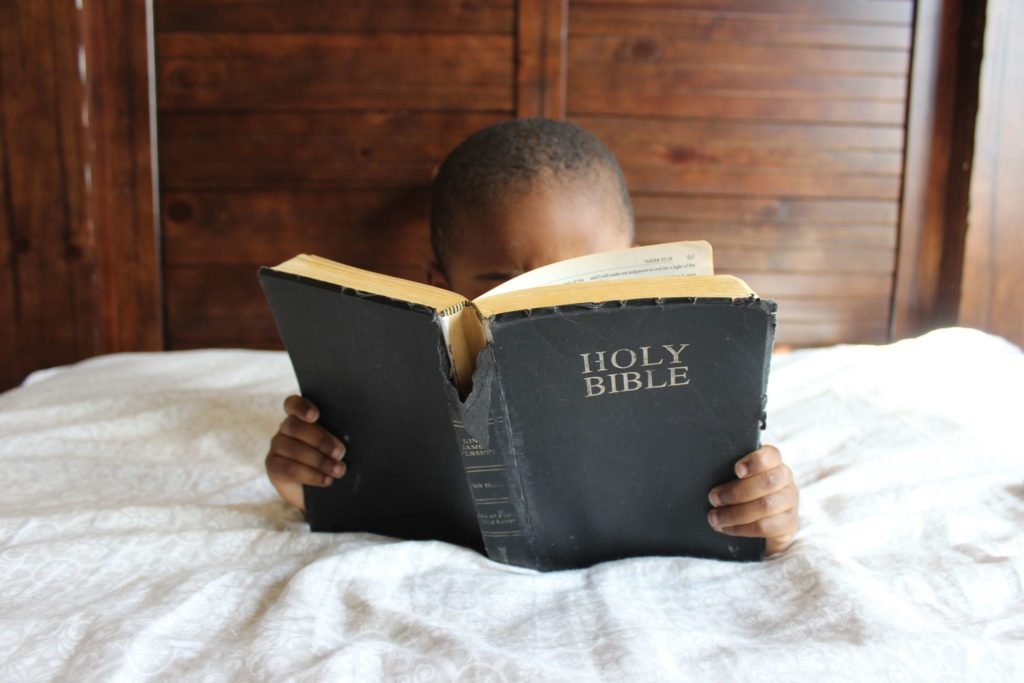

Biblically Responsible Investing

Biblically responsible investing, sometimes referred to as BRI, has a range of positive and negative factors. Some Christians are very strict in their choice of acceptable investments; others may be more liberal. The choice all depends on the individual’s views. Some of the positive and negative screens can be:

- Abortion

- Abuse of poor, children and the elderly

- Alcohol

- Christian persecution

- Community involvement

- Corporate governance

- Discrimination

- Entertainment (adult and youth)

- Environmental care

- Firearms

- Fiscal responsibility

- Gambling

- Justice and mercy for the poor and needy

- Lifestyles

- Military and armaments

- Pornography

- Substandard labor practices

- Support for charities

- Support of the Jewish people and the State of Israel

- Tobacco

Speaking as a Christian, we are imperfect people trying to live in harmony with others and follow God’s laws. The Bible gives guidance in making choices and not criticizing others. The Apostle Paul writes in Romans 14: 1-3, “Those who feel free to eat anything must not look down on those who don’t. And those who don’t eat certain foods must not condemn those who do, for God accepted them. “11

How do you limit or restrict investments based on your beliefs and morals?

Once you have an understanding of what is an acceptable and unacceptable investment in your eyes, then you have the challenge of finding investments to satisfy your preferences. There are three ways to go about this process.

- Select mutual fund or ETF’s that fit your criteria as close as possible

- Select individual stocks

- Invest in a direct index that meets your criteria exactly.

Direct Indexing gives you control

Depending on a client’s objectives, I use all three methods in my practice. However, I believe that direct Indexing offers the best option for individuals that want to have more control over the type of investments that own. Direct Indexing for any theme of principle-based investing gives investors the ability to invest directly into indices without going through a mutual fund or ETF structure.

Fractional Shares

Modern direct Indexing offers the opportunity for investors to use fractional shares too. So you can have the diversification of an entire index without a large sum of money. Plus, you can avoid the trading fees by using a custodian that offers zero-cost trading.

Tax Treatment

Unless you have investments in a tax-advantaged structure like a 401(k) or IRA, taxes can erode any profits. Direct Indexing allows investors to take advantage of tax losses while deferring taxable gains. This is a significant advantage over mutual funds or ETFs. Both mutual funds and ETFs are subject to panic selling when the stock market declines. Mutual funds are more susceptible than ETFs. In market declines, mutual funds and ETFs can be forced to sell long-held stocks to give redemptions to shareholders. Forced stock sales can result in phantom income for shareholders.

In other words, some mutual fund and ETF holders can have taxable capital gains without selling their shares. This can even occur if there is a loss in the actual value of the shares. Direct Indexing avoids phantom income because you are not forced to sell your shares at any time. You sell the shares only when you want to. In contrast, ETFs and mutual funds cannot selectively take advantage of tax losses.

Active vs. Passive

Direct Indexing is a passive strategy. This is a strategy that has gained notoriety over top of the active management strategy where portfolio managers are attempting to outwit the market. For the right situation, active fund management can offer some advantages. But for some long-term investors, passive investing does have benefits. This is especially true for those that want to defer taxes and avoid the pitfalls of panic selling.

Passive does not mean inactive

However, the passive nature of direct Indexing does not mean that you never do anything to your account once it is established. The direct indexing strategy that I employ uses another tool called smart beta. Smart beta is a type of investment filter that takes the human behavioral bias out of the investment monitoring and selection process. Stocks are removed from that index if they are low performing, low profit, higher volatility, or any other factor that is practical and academically prudent. Smart beta is used in conjunction with the tax harvesting strategies previously mentioned.

There is still risk

I think it is important to point out that even though the smart beta is a widely used strategy, there is still risk. The process has no guarantee or warranty of success. Investors are still subject to losses as well as gains.

Direct Indexing is also cost-effective.

Direct investing is very cost-effective. As previously mentioned, the direct indexing strategy I offer to clients is based on a fee-only cost. If stock trades are made within set time-frames, there is no trading fee or commission. A straightforward cost structure is essential because there could be the potential for hundreds of transactions.

As long as clients follow the structure of the direct indexing program, there are only two costs. The research to establish the stock index and the ongoing smart beta research cost 0.40% annually. My firm’s advisory fee of continuing service ranges from 1% annually for smaller accounts to 0.40% for larger accounts. Complete details are available for those that are interested from me directly.

Step 3. Set up an account and monitor the process

Before picking whatever principle-based investing strategy that appeals to you, it is vital to see how it will fit into your overall financial situation and future goals. In this world, it is crucial to have a plan for what you want. If you don’t, you can be sure that there is someone or some business entity that has a plan for you. To determine the best course of action for your retirement or investment accounts, you should begin by creating a written plan; a plan includes your goals, morals, and beliefs. You can take that first step with a conversation with me. I’m Van Richards. I’m a Chartered Financial Consultant, and I can help you develop a plan that follows your goals, morals, and beliefs and not run out of money during retirement. You can set up a time to talk by going to my website at RichardsFinancialPlanning.com

References

1 Walsh, Bryan. “The world’s most polluted places.” TIME.com. Last modified September 12, 2007. https://content.time.com/time/specials/2007/article/0,28804,1661031_1661028_1661022,00.html.

2 “Russian Arctic Oil Spill Pollutes Big Lake.” BBC News. Last modified June 9, 2020. https://www.bbc.com/news/world-europe-52977740.

3 Beer, Jeff. “One Year Later, What Did We Learn from Nike’s Blockbuster Colin Kaepernick Ad?” Fast Company. Last modified September 4, 2019. https://www.fastcompany.com/90399316/one-year-later-what-did-we-learn-from-nikes-blockbuster-colin-kaepernick-ad.

4 Kelley, Alexandra. “Nike inc. announces $40 million donation to black community organizations.” The Hill. Last modified June 5, 2020. https://thehill.com/changing-america/respect/equality/501369-nike-inc-announces-40-million-donation-to-black-community.

5 MSCI ESG Research, LLC. “Racial diversity data, contractor safety at construction companies during COVID-19.” Podcast audio. June 12, 2020. https://www.msci.com/esg-now-podcast

6 Bitters, Janice. “San Jose-based Cisco promises $5M for charities fighting racism, discrimination.” San José Spotlight. Last modified June 10, 2020. https://sanjosespotlight.com/san-jose-based-cisco-promises-5m-for-charities-fighting-racism-discrimination/.

7 Profiles in Diversity Journal. “Cisco – diverse representation framework.” Diversity Journal. Last modified 2016. https://diversityjournal.com/16616-cisco-diverse-representation-framework/.

8 Depersio, Greg. “The best (and worst) companies for workplace diversity.” Investopedia. Last modified April 21, 2020. https://www.investopedia.com/articles/professionals/072815/best-and-worst-companies-workplace-diversity.asp#:~:text=Some%20companies%20excel%20with%20workplace,Stryker%2C%20Cisco%2C%20and%20Accenture.

9 McCrum, Dan. “Wirecard: the timeline.” Financial Times. Last modified June 25, 2020. https://www.ft.com/content/284fb1ad-ddc0-45df-a075-0709b36868db.

10 MSCI ESG Research, LLC. “Wirecard collapse expose lack of proper governance.” Podcast audio. June 12, 2026. https://www.msci.com/esg-now-podcast.

11 Romans 14: 1-3. NLT Study Bible. Carol Stream, Illinois: Tyndale House Pub, 2015.

Leave a Reply