Here is how to fight inflation in retirement

I’m Van Richards, ChFC®. A key to your success in retirement is learning to fight inflation. With this in mind, I design financial plans that can protect your income, control your expenses, and identify tax savings. Given these points, I created a step-by-step process to help you have a successful retirement. It is called the Easiest Retirement Budget Plan. There are three steps to this inflation-fighting plan.

#1. We meet virtually to discuss your goals and concerns.

#2. We complete the Easiest Retirement Budget Worksheet.

#3. We implement a plan to help you fight inflation.

Discussing Your Goals and Concerns

Fighting inflation in retirement doesn’t mean that you have to sacrifice everything. On the contrary, when we discuss creating a retirement budget plan for you, we want to begin with what is important to you. In particular, what do you want to do when you’re retired?

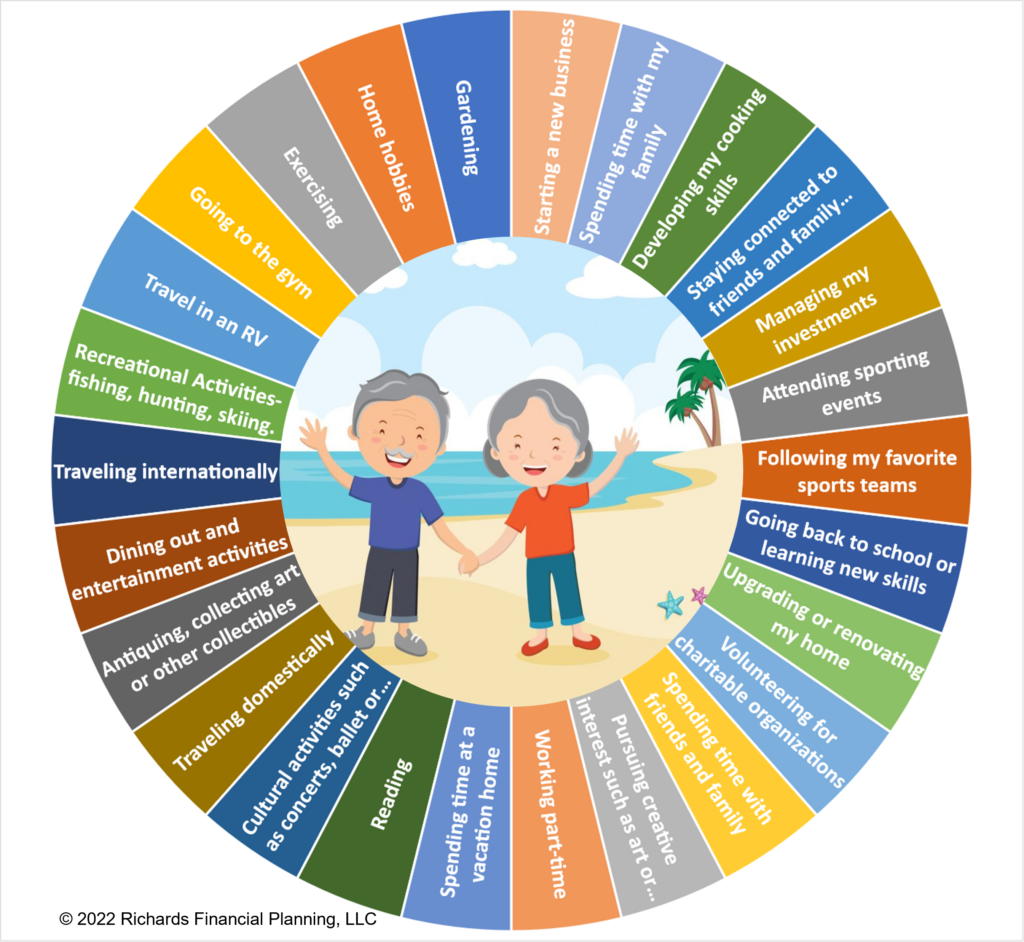

In the following diagram, you will see numerous things that people find important in retirement. Look through the diagram and find what is important to you. Of course, there will be more than one item.

Before you complete the Easiest Retirement Budget Worksheet, I want to invite you to let your imagination take you into what you want retirement to be like.

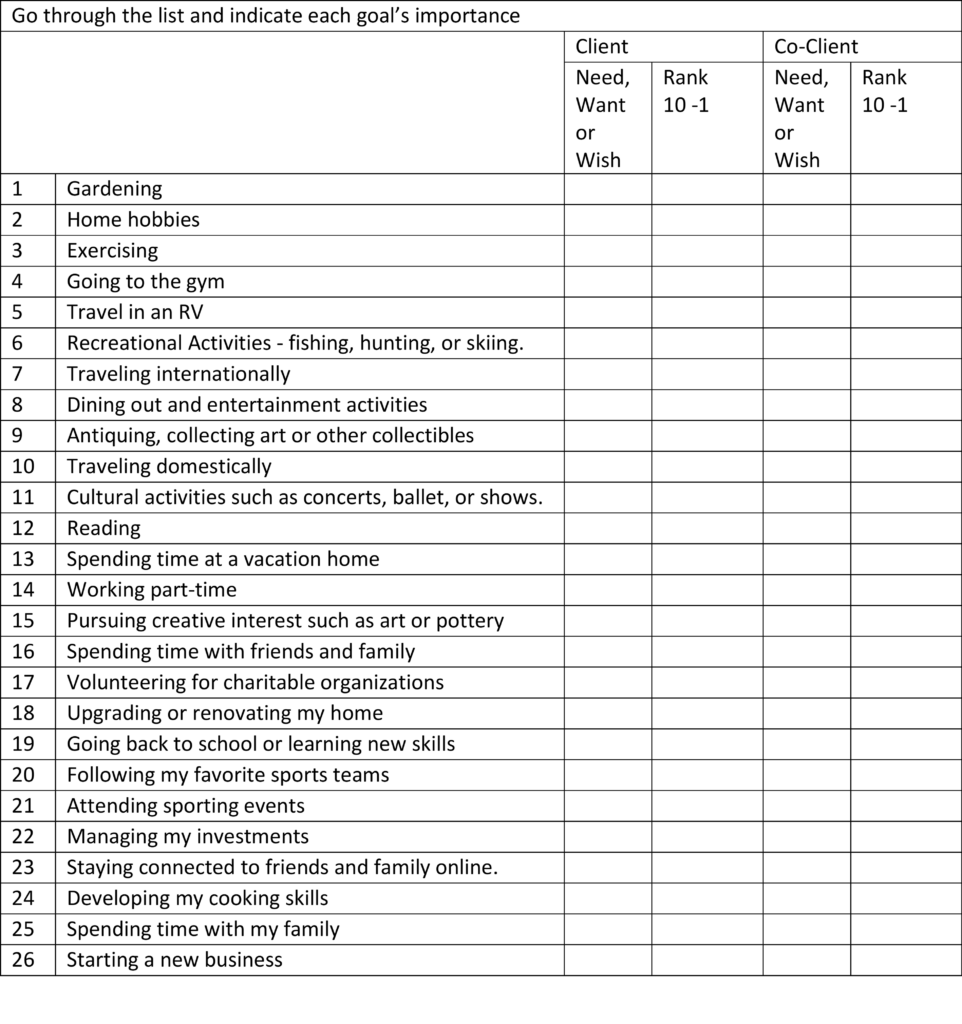

Let’s begin by defining your wants, needs, and wishes. And then, we’ll look further at your expectations and concerns. But to start discussing your wants, needs, and wishes, I’d like you to use this scale.

Retirement Goals and Concerns Scale

There are two ways you can use this scale. The first way to look at your needs, wants, and wishes is with the diagram below. As an illustration, the circle of goals is to help you visualize the possibilities available to you. In like manner, the same goals are written in a spreadsheet that follows. You may find it easier to write the needs, wants, and wishes with the corresponding number on the spreadsheet. For this purpose, use whichever tool you want to help you clarify your needs, wants, and wishes in retirement.

Go through the list and indicate each goal’s importance on a scale of 10 – 1, with 10 being the most important. Then, based on the 10 to 1 scale, group your goals by needs (what you must have), wants (what you would like to have), and wishes (what you wish to have).

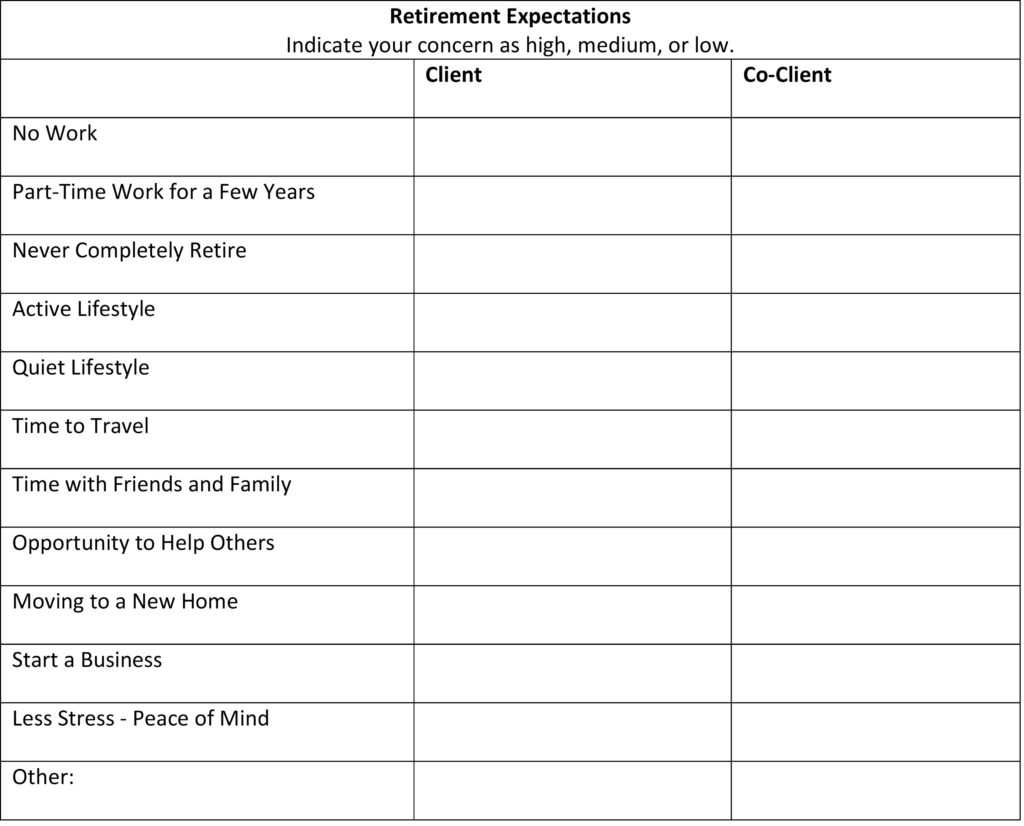

Expectations & Concerns

A retirement budget plan should begin with your expectations and concerns. The retirement expectations section is so important because here is where you will focus on what you genuinely want retirement to be like. Several ideas are listed below, but if you have something else in mind, write it down. Truly, writing things down helps you solidify what is on your mind and in your heart. Additionally, keep in mind that your expectations can change. You may even find that they change after you complete the Easiest Retirement Budget Worksheet.

Once you start to see where your money will be spent more specifically, you may need to adjust some of your expectations. Undeniably, solidifying your expectations will be to your benefit. To put it another way, it’s a terrible feeling to have your expectations fall short. For this reason, planning will help you avoid or at least limit the frustration of false expectations.

So, what do you look forward to the most? What worries or concerns you? Go through the list below and indicate if you have high, medium, or low expectations of the items listed. Again, if you have something else on your mind, write it in the other section. If you need more room, use an additional blank page.

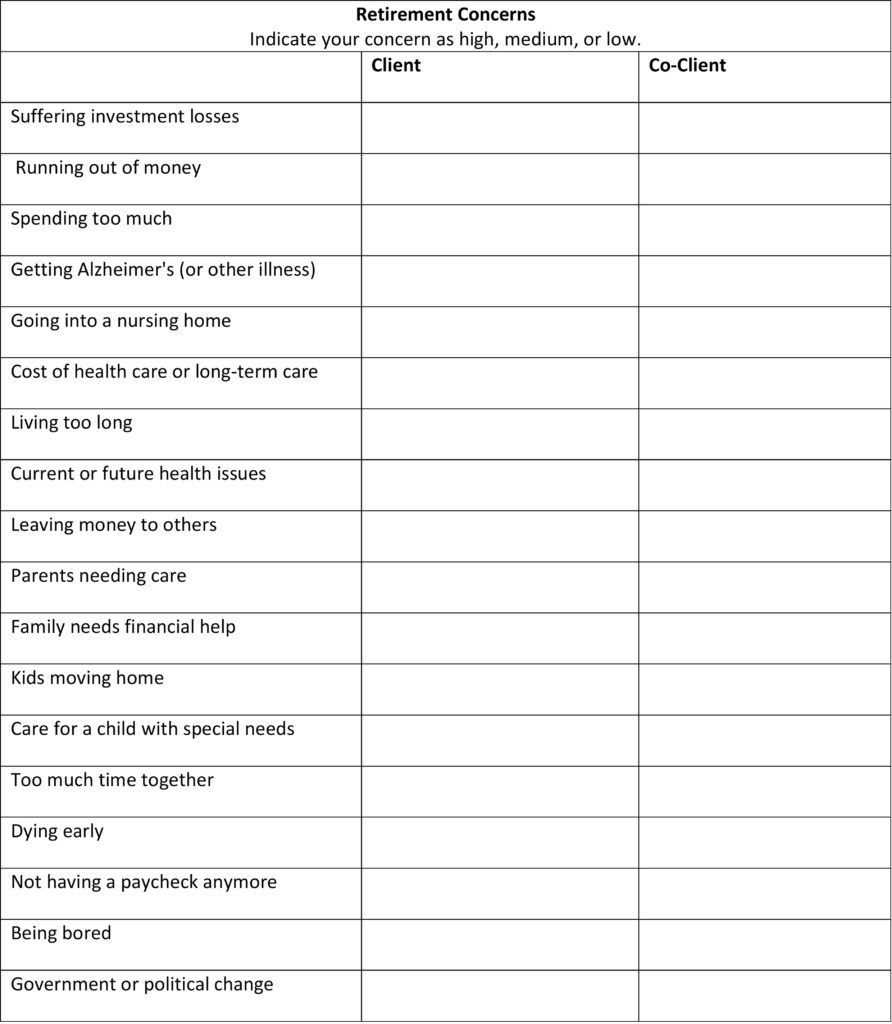

Retirement Concerns

Equally important to consider are your retirement concerns. Go through the lists below and indicate the areas that concern you the most. Keep this in mind. All things considered, anything that happens in retirement will be affected by six risks that you will face in retirement.

- risk of investments

- risk of getting older

- risk of not working

- risk of family dilemmas

- risk of running out of money

- risk of government and political change.

With this in mind, go through the spreadsheet below and indicate what worries you the most. When we get to the Easiest Retirement Budget Worksheet, we’ll focus on planning that you have enough money to take care of what is worrying you the most.

Taking inventory of your resources

The next step is one of the most critical steps to controlling the effects of inflation in retirement. With this in mind, take an inventory of your money spending habits with the Easiest Retirement Budget Worksheet. You can download the worksheet by clicking here.

I have created a guide to help you complete the worksheet. You can see the guide by clicking here.

Need help with retirement planning?

If you have gotten to this point and feel unsure about what to do, you are not alone. You may be at a point where a real person with the education and experience to help you plan your retirement may be the answer to your uncertainty.

If you live in Texas, I may be able to help you by personally guiding you through the three steps to this inflation-fighting plan. We can

#1. Meet virtually to discuss your goals and concerns.

#2. Work together to complete the Easiest Retirement Budget Worksheet.

#3. After reviewing the options available to you, we implement a plan to help you fight inflation.

Working with you individually is a fee-based service. If you’d like to learn more about our fee-for-service structure, visit our fees page here.

Essentially, we can objectively help you plan a retirement strategy, determine the cost of retirement, give you the best options to accomplish your goals, and fight inflation in retirement. Click here to get started:

© 2022 Richards Financial Planning, LLC All rights reserved.