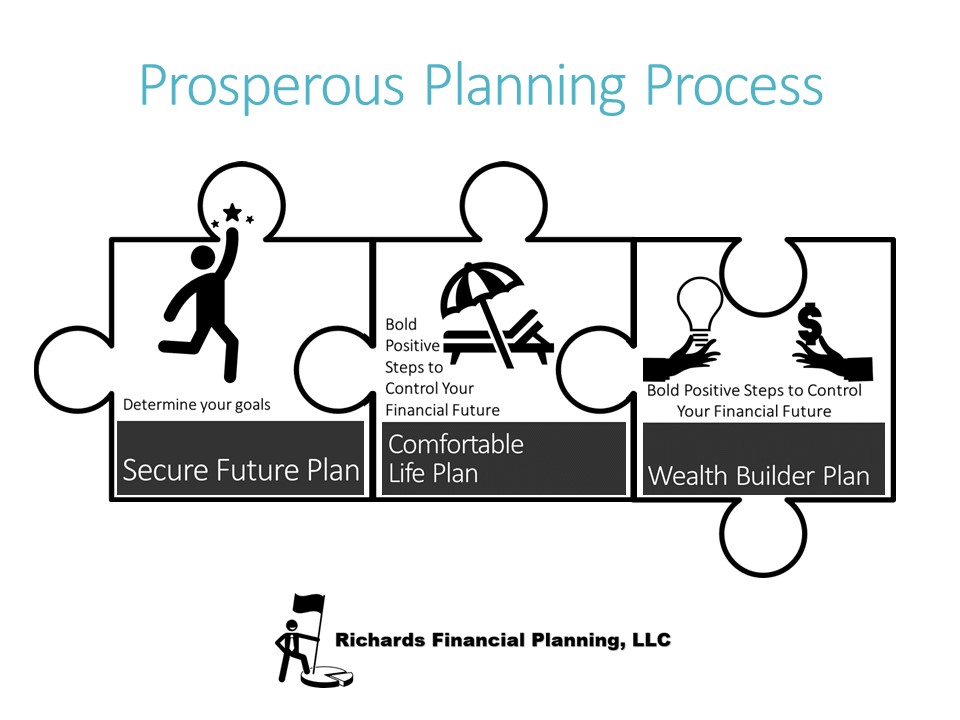

The Prosperous Planning Process is a step-by-step method of getting your finances under control and reducing the financial frustration in your life. A lot of people experience frustration with their finances. And it is not only those with a low-income. Many people with six-figure incomes have little to no cash flow. I’m Van Richards. I am a Chartered Financial Consultant, and I help people overcome the frustration of controlling their finances. I design financial plans that can give you the choice of planning for financial security, comfort, or wealth. Here is an introduction to The Prosperous Planning Process. There are three segments to the Prosperous Planning Process.

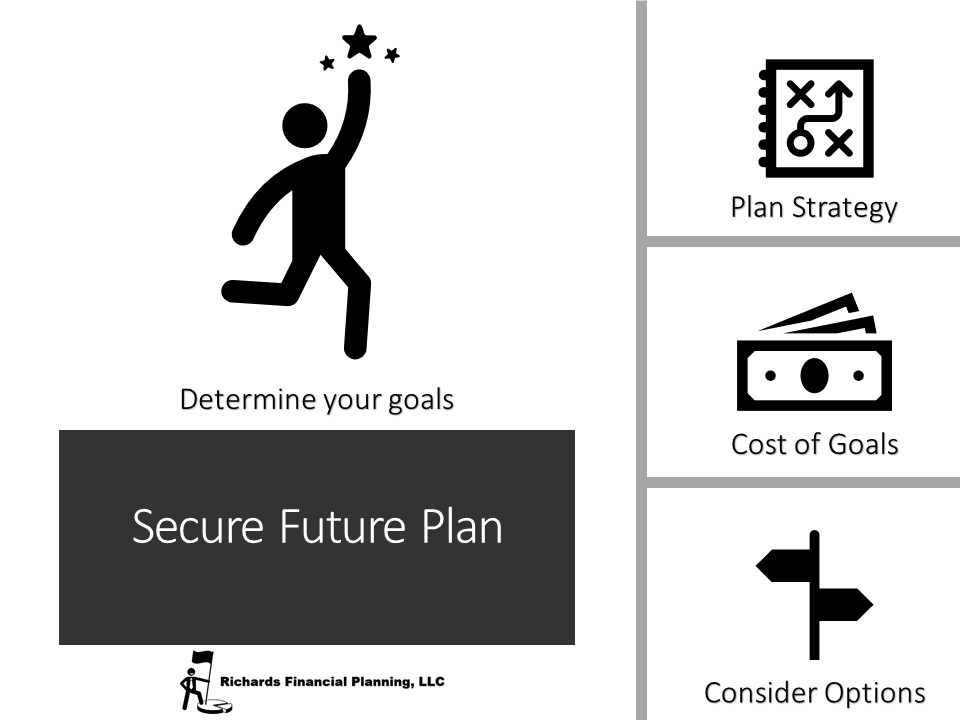

Secure Future Plan

Not everyone needs the same level of financial planning. That is why I approach financial planning in three segments called the Prosperous Planning Process. You start with the basics through the Secure Future Plan. This segment helps you establish financial security. Then, the Prosperous Planning Process or PPP allows you to add more to your plan when you need it.

One plan leads to another. So you do not need to have more planning done than necessary. The PPP begins with the Secure Future Plan. There are three parts to the Secure Future Plan:

- Determine your goals

- Estimate the cost of your goals

- Plan options to achieve your goals

Go from frustrated to in-control

The Prosperous Planning Process is a fee-based service. It is a service that can take you from a lack of cash flow to an abundance. The information here can help anyone. However, the Prosperous Planning process is a financial planning process that works best for those with $250,000 or more in investable assets. The first segment, the Secure Future Plan, costs $335. To help you see how this financial plan can take you from frustrated to in-control, I offer you a free introduction. Accordingly, you can see how the Prosperous Planning Process can help you secure your financial future.

Below, you will see more details on the end result of your free introduction. However, this is the bottom line. Based on your goals and information, I can give you a statistical probability of you obtaining your goals. We can then discuss how certain changes could improve your chances of success. I will walk you through the process live online through a secure meeting. It only takes about fifteen to twenty minutes for the free introduction. Here is the basic information you will need.

Beginning planning data

- Your name and that of your spouse if married plus your dates of birth

- Your employment status and income

- You will need a total dollar amount of your investable assets. It will be helpful to break that amount into the percent in and outside of your retirement plan. Plus, what is the amount you are saving for retirement? And what is the allocation of your investments? In other words, how are your assets divided between stocks, bonds, etc.?

- Finally, let’s determine your risk tolerance. On a scale of one to ten, with a one being very conservative and a ten being very risky, what number would you give to your willingness to accept risk. If this is a hard question to answer, don’t worry. We can determine your comfort level for risk when we talk. Please ask your spouse the same questions. Both answers do not need to be the same.

The big picture

In the Secure Future Plan, we use general estimates for your goals based on your age and gender. It is essential to consider your needs, wants, and wishes. We begin with estimates for retirement as well as your projected basic living expenses. Additionally, we take into consideration health care expenses and transportation expenses. Then we add in estimates for things you want, like travel, a new or replacement vehicle, and fun money in your budget. Lastly, we add a general estimate for the amount of money you may want to spend on particular wishes. Some examples might be home improvement, charity, or financially assisting family members.

Here’s what you get

The most important information I will be able to give you will be a success score. In other words, based on the essential information you provide, I can give you an estimate as to the probability of your financial success. The score is a percentage between one and one-hundred. If your score is low, I can outline a financial plan that can help you succeed financially.

With the primary data you supply, here is what I can help you determine.

Based on your age, I can help you estimate your Social Security benefits and determine the best strategy for collecting Social Security. I can also help you decide on your future healthcare cost and talk about how long you should plan to receive an income. In other words, what do you think your life expectancy will be. I have some guidelines for you to consider. But we should use a number with which you feel comfortable.

Based on your income, I can estimate your Social Security benefits, retirement living estimates, and how to fulfill the goals you set.

A difference between plans

Lastly, we determine the estimates based on your income and estimates for key goals. If you decide to complete the Secure Future Plan, all the calculations are replaced with your specific goals.

If this level of financial planning satisfies your needs, then we stop here. However, if you need guidance for budgeting, investment advice, or alternatives to build more of a financially comfortable life, you should proceed to the Comfortable Life Plan. If you’d like to discuss how The Secure Future Plan can help you click here to schedule a time to learn more.

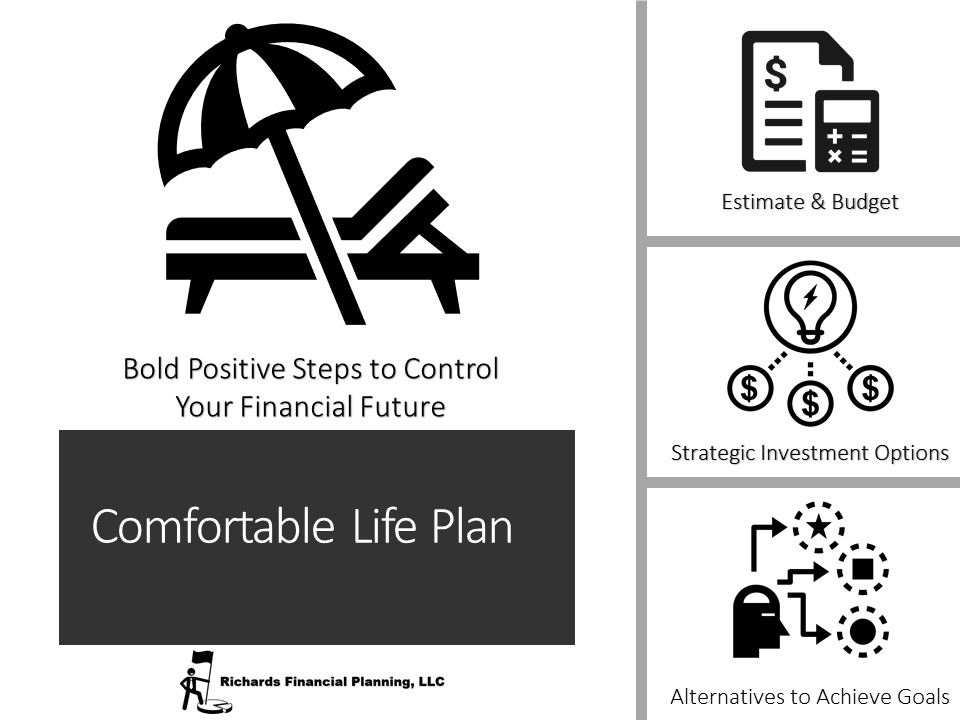

Comfortable Life Plan

The first segment, the Secure Future Plan, is designed to give you a foundation for your finances. But what if you want more? If you want to have a life that allows you more financial flexibility, you will need to plan to guide your saving and spending habits. Plus, you will need a strategy to grow your net worth to have a comfortable life. You need an investment strategy.

The Comfortable Life Plan looks holistically at your finances. This segment of the Prosperous Planning Process builds off of the firm financial foundation that you have established in the Secure Future Plan.

The second segment, the Comfortable Life Plan, analyzes your current savings and investment strategy’s effectiveness. The plan will give you a probability of success rating between 1 and 100. Then we will look at alternatives to improve your probability of financial success.

The Comfortable Life Plan uses a “what if” strategy and will give you alternatives to improving your financial success chances. In the “what if” approach, we look at what would happen if you alter your goals, what would happen if you changed the time horizon for fulfilling your plan, plus what if you changed the funding and investment strategy to acquire your goal.

The importance of reviews

In this planning segment, you can get an idea about how the changes discussed will affect your chances of success. The Comfortable Life Plan involves financial counseling and strategic planning. I give you the information you need to make informed decisions on obtaining the comfortable life you want.

You may have heard the John Steinbeck quote, “the best-laid plans of mice and men often go awry.” That quote applies to financial planning too. You can make the best plans today, but tomorrow’s circumstances may change everything. So I stick with you (if you want).

Some people want a one-time financial plan. Then again, others recognize the need for ongoing guidance. I offer you both options. If you choose the Comfortable Life Plan, you will have a methodically written financial plan. If you wish continuing advice, I give you two choices. We get back together at least once a year to review and make adjustments to your plan. Two, I help you manage your investments and give you ongoing guidance and quarterly updates about your financial plan’s assets.

What’s the cost?

The Comfortable Life Plan usually entails about six hours of advisor research and planning. The costs start at $1,000. The design of the Prosperous Planning Process is to work in tandem with each other. So, this expense is in addition to the cost of the Secure Future Plan. Depending upon the complexity of your situation, the fee may be more. If you choose ongoing investment advice, the charge is a percentage of assets under management beginning at 0.90% for $250,000 and up. As the dollar value of assets increases, the management fee decreases. For more details on fees, go to the fee page of Richards Financial Planning, LLC. If you’d like to discuss how The Comfortable Life Plan can help you click here to schedule a time to learn more.

Info needed to start

Just as a reminder, you can see how the Prosperous Planning Process can help you secure your financial future with a free introduction. An advisor will walk you through the process live online through a secure meeting. It only takes about fifteen to twenty minutes for the free introduction. Here is the basic information you will need.

- Your name and that of your spouse if married plus your dates of birth

- Your employment status and income

- You will need a total dollar amount of your investable assets. It will be helpful to break that amount into the percent in and outside of your retirement plan. Plus, what is the amount you are saving for retirement? And what is the allocation of your investments? In other words, how are your assets divided between stocks, bonds, etc.?

- Finally, let me know what your tolerance is for risk. On a scale of one to ten, with a one being very conservative and a ten being very risky, what number would you give to your willingness to accept risk. Please ask your spouse the same questions. Both answers do not need to be the same.

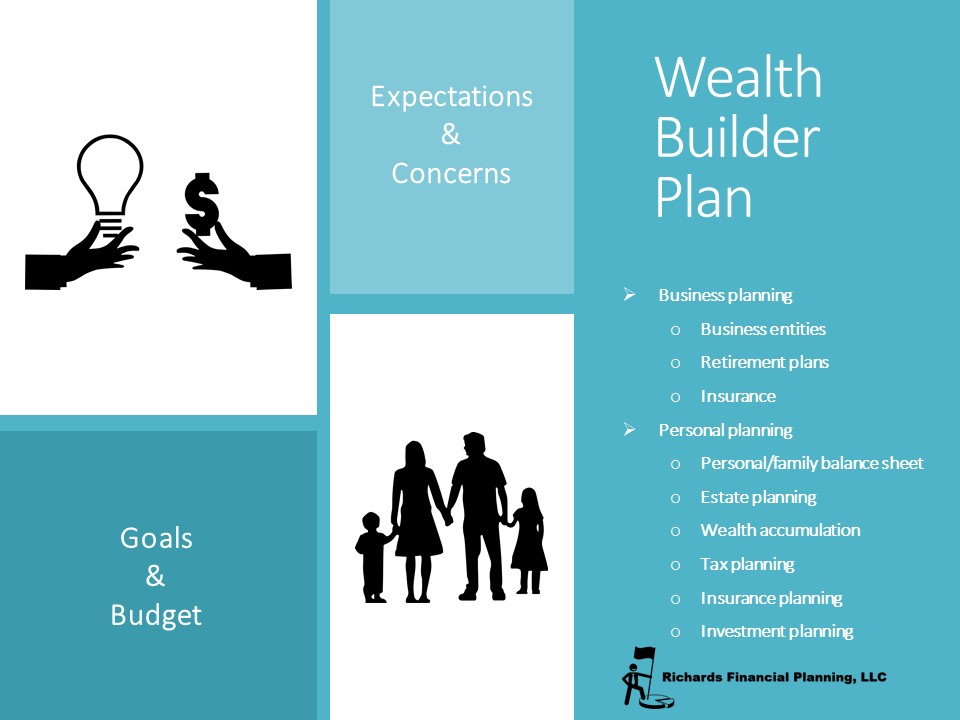

The Wealth Builder Plan

For some people, financial planning is more than stability or more than building a comfortable life. For some people, financial planning is about building wealth through personal financial management and business enterprises.

Every Wealth Building Plan is unique and works in tandem with the first two segments of the Prosperous Planning Process. However, here are a few examples of outlines of a Wealth Building Plan for the following scenarios. If you’d like to discuss how The Wealth Building Plan can help you click here to schedule a time to learn more.

A Couple in Their Mid-Twenties

- Discuss expectations and concerns

a. What would you like your future to be like? - Goals & create a budget

a. Home purchase

b. Plans for a family (if appropriate)

c. Buy life insurance and create a simple will - Personal planning

a. Tax planning

i. Build net worth by tax benefits of a mortgage

ii. Choose where to save (pre-tax, tax-free, or after-tax) - Insurance planning

i. Medical insurance

ii. Disability insurance

iii. Life insurance

iv. Property & liability insurance - Investment planning

i. Emergency Fund

ii. Home purchase

iii. Invest through an employer plan

iv. Personal investment

v. Plan a business (if appropriate)

A Couple in Their Forties in One or More Professional Practices

Discuss expectations and concerns

- What would you like your future to be like?

- What are your retirement concerns?

Establish goals & create a budget

- What are your lifestyle goals?

- Travel, college, home improvement, new home, provide family care, start a business, major purchase, leave a bequest, wedding, celebration, gifts, or donations? On a scale of one to ten, how important are these goals? 10-8 would be something you absolutely need, 7-4 would be something you want, and 3-1 would be a wish.

- Do you have a desired retirement age?

- Funding for children’s education (if appropriate)

- Residence & commercial real estate

- Discuss survivorship, wills, trusts, and guardianships

- What is your family’s historical life expectancy?

Business planning

- Clarify respective practice business entities

- How do you own your practice?

- i.e., LLC, PA, sole proprietorship, etc.

- How do you own your practice?

- Qualified & non-qualified retirement plan tax and savings alternatives

- Insurance planning

- Medical, disability, and life insurance

- Business overhead expense disability insurance

- Buy-sell funding

- Property & liability insurance

- Professional liability insurance

Personal planning

- Do you have a will, and when was it created?

- When did you sign your wills?

- Do you own, or are you associated with any trust?

- Where are your wills?

- Do you have a medical directive?

- Do you have a power of attorney?

- Wealth accumulation plan

- If you qualify for Social Security, what do you expect?

- What other retirement assets and accumulation plans do you have?

- Do you expect work to be part of your retirement income?

- Tax planning

- Do you own stock options, restricted stock, or deferred compensation?

- Insurance planning

- What type of insurance do you own?

- When was it purchased?

- Investment planning

- What is your current investment or savings plan?

- How are your investments owned?

An established business owner and spouse in their sixties who are majority shareholders in a corporation with employees.

- Discuss the length of involvement in business and eventual disposition of business.

- Discuss objectives for retirement (if appropriate)

- Sources of retirement income

- With business ongoing or post business sale

- Time segmentation

- Income flooring

- Systematic withdrawal

- With business ongoing or post business sale

What’s the cost?

Just as another reminder, the Prosperous Planning Process is a fee-based service. The third segment, the Wealth Builder Plan, costs a minimum of $665 in addition to the $335 for segment number one and $1,000 for second number two. Depending upon your situation’s complexity, the Wealth Builder Plan may have an additional cost. We will give you the cost for your approval before work on your financial plan begins. To help you see if financial planning is right for you, we offer you a free introduction. You can see how the Prosperous Planning Process can help you secure your financial future. An advisor will walk you through the process live online through a secure meeting. It only takes about fifteen to twenty minutes for the free introduction. Here is the basic information you will need.

- Your name and that of your spouse if married plus your dates of birth.

- Your employment status and income

- You will need a total dollar amount of your investable assets. It will be helpful to break that amount into the percent in and outside of your retirement plan. Plus, what is the amount you are saving for retirement? And what is the allocation of your investments? In other words, how are your assets divided between stocks, bonds, etc.?

- Finally, let me know what your tolerance is for risk. On a scale of one to ten, with a one being very conservative and a ten being very risky, what number would you give to your willingness to accept risk. Please ask your spouse the same questions. Both answers do not need to be the same.

If you’d like to discuss how The Prosperous Planning Process can help you, click here to schedule a time to learn more.