The “learn more” call is about a fifteen-to-twenty-minute call to allow you to see if you think the Easiest Retirement Budget Plan will help you. The call is done by phone or over Zoom. It is your choice how we do the call. Although, if you do the call over Zoom, we can share our screen to see the information we are discussing.

When you click on the “schedule a call to learn more” button, you will go to our scheduling page. Generally, we do “learn more” calls on weekday mornings. But there are also time slots available on Thursday evening, and a short time on Saturday morning is available.

Who is on the call?

I am Van Richards, and I conduct the “learn more” calls. I am an experienced financial advisor. If you want to know more about me, I invite you to read our firm’s website’s “about” page. Click here.

What will we talk about?

When you schedule a call, it is an introduction call, so it will not take much of your time. The first thing is to explain our three-step process. In brief, here are the three steps.

- Discussing your goals and concerns

- Completing the Easiest Retirement Budget Worksheet

- Implementing a plan to help you fight inflation

The Circle of Goals

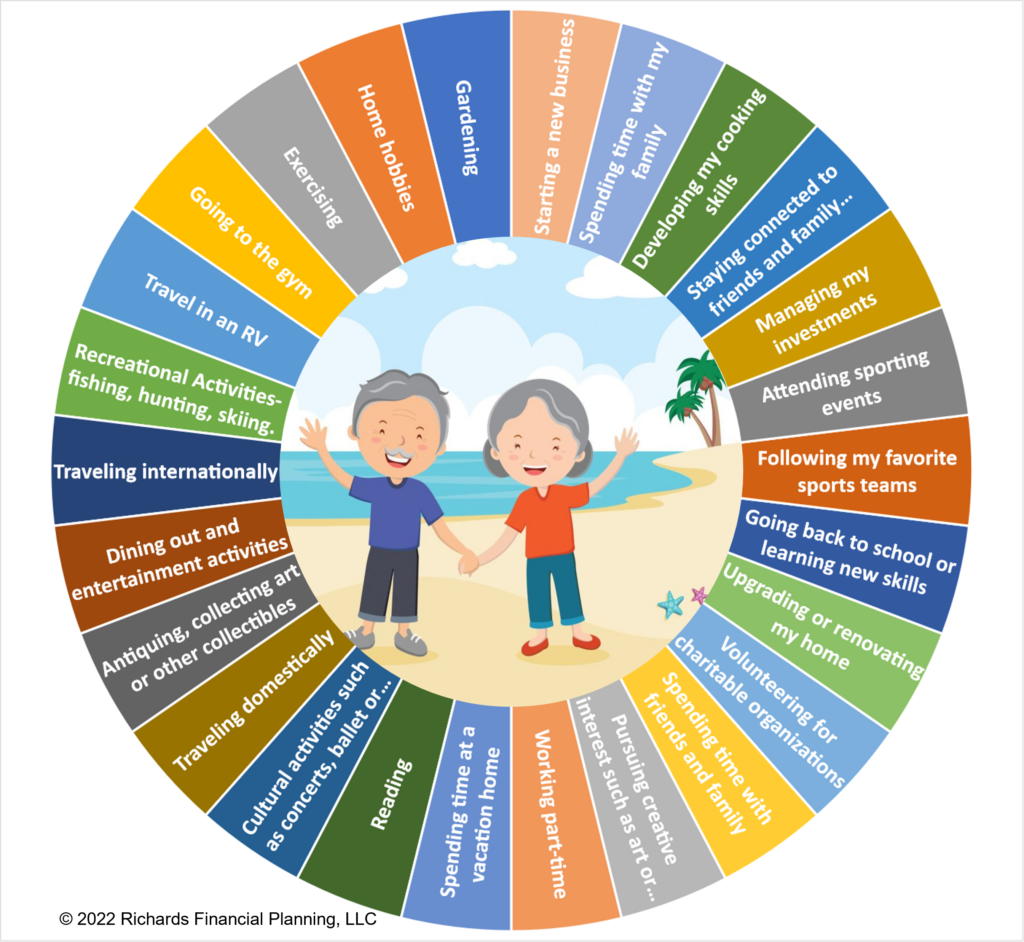

Inflation is not your fault, and we want to help you enjoy retirement as much as possible. So, in our brief call, we’ll explain how we help you focus on what is important to you and fight inflation. For this purpose, we have created the Circle of Goals.

In our call, we’ll explain how to use the Circle of Goals to work toward creating a retirement life that focuses on what is important to you.

The Easiest Retirement Budget Worksheet

If you feel your income is pinched, you’re not alone. A recent study shows that a significant portion of the wealthiest Americans live paycheck to paycheck. 1 Moreover, it’s a fact that inflation makes people poorer. For this reason, I created a retirement budget worksheet that is very easy to use. I will give you that unique worksheet for free. Plus, I’ll show you how to use the worksheet to protect your income, reduce your expenses and identify tax savings.

Implementing a plan to help you fight inflation

I’ll discuss how we design a written plan that will help you protect your income, reduce your expenses, and identify tax savings. We call that plan the Easiest Retirement Budget Plan. It is a fee-based service. Your end cost depends upon the type of service you need and how much time it takes to complete the plan. An overview of our fee structure is on our fees page. If you’d like to see a sample outline of a complete written plan, I will forward that to you. But rest assured that our initial conversation will cost you nothing. The initial call is free.

Above all, I’m not going to ask you to commit to working with our firm on our first call. All I am going to ask you is if you would like to receive the Easiest Retirement Budget Worksheet, and would you like to talk again to answer your follow-up questions. So, if you’re ready to schedule a call to learn more, click the button below.

If you’re not ready yet, no problem. In the meantime, if you’d like to learn more about our planning process, click here.

1 LendingClub Corporation. (2022, April 4). Half the share of the wealthiest Americans now lives paycheck to paycheck. Retrieved June 3, 2022, from https://ir.lendingclub.com/news/news-details/2022/Half-the-Share-of-the-Wealthiest-Americans-Now-Live-Paycheck-to-Paycheck/default.aspx