The Perfect Plan

Imagine retiring and having a perfectly efficient plan for using your money. A plan that allows you to have enough money to last as long as you live. And a perfect plan that enables you to use every penny that you have before you leave this great big blue and green ball called Earth! As good as that sounds, nobody has a crystal ball to plan that perfectly. But a well-managed systematic withdrawal plan for retirement income can give you the next best use of your money. If managed well, it allows you to have an income without running out of money during retirement.

So how does a systematic withdrawal plan for retirement income work? It is a simple concept where a regular amount of money is taken from a money source. As straightforward as it sounds, the devil is in the details.

How the Systematic Withdrawal Plan Began

William Bengen is credited with the development of the concept of the systematic withdrawal plan for retirement income.[i] In the late 1980s and early 1990s, the stock market went through some terrific years. So much so, that a lot of people thought that they could routinely take double-digit withdrawals from their retirement accounts and never run out of money. Bengen’s work determined that a portfolio of 50% stocks and 50% bonds would sustain a 4% inflation-adjusted safe withdrawal rate for at least 30 years. The 4% safe withdrawal rate takes into consideration the many market cycles that have happened over the past 30 years. The period that Bengen referred to was the 30 years leading up to his study in the 1990s. Times and economic conditions have changed.

More recently, Dr. Wade Pfau has expanded the “safe withdrawal” concept to encompass the low-interest-rate environment that we are currently experiencing. Dr. Pfau’s conclusion is that the safe withdrawal rate is now 2.4%.[ii] When putting the safe withdrawal plan into practice, 96% of the time, the principal remains at the end of the 30 years. Furthermore, higher withdrawals of 5% to 5.5% may be feasible if adjustment triggers are set and maintained. [iii] We’ll discuss making adjustments in a moment.

How do we make decisions about the future?

Another important aspect of plotting a systematic withdrawal plan is how you determine your probability of success. You can use past data or forward-looking data. Some people feel that what happened to the stock market in 1920 will indicate what will happen in our future. I tend to disagree with that approach. While it is important not to make mistakes of the past, it is more important to look forward. In my practice, I look at the recent economy and estimate the reactions of investments based on current and anticipated economic conditions.

How a Systematic Withdrawal Plan Works

There are five variables to a systematic withdrawal plan. They are the beginning amount of money, the rate of withdrawal, your tax rate, the rate of profit the account regularly obtains, and the rate of inflation. A change with one factor affects everything.

A Systematic Withdrawal Plan using 4%

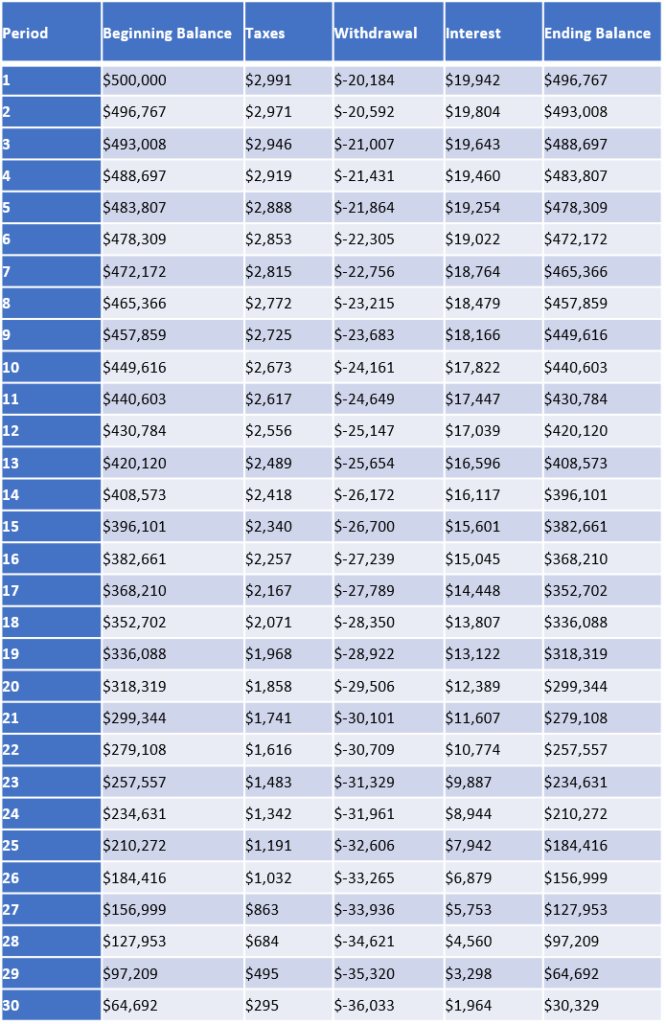

Here is an example. Let us start with the beginning numbers; a beginning balance of $500,000, a 4% annual return, and a withdrawal of 4% or $20,000 to begin. The inflation rate is 2%, and the marginal tax bracket for this example is 15%. With these specific variables, the money would last about thirty years.

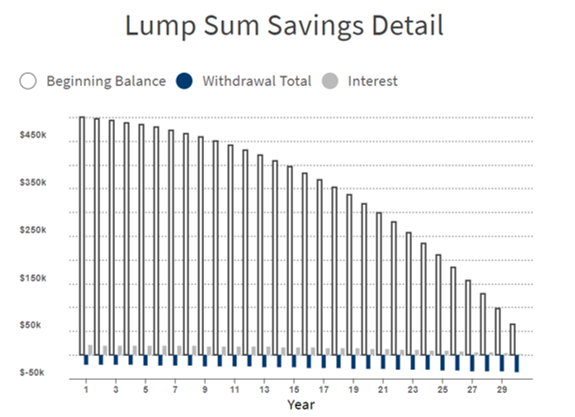

Below is a graph of this systematic withdrawal plan and to follow is the specific withdrawal numbers.

Explaining the systematic withdrawal plan may be putting the cart before the horse. Before you begin your income plan, you must have a solid understanding of how you are spending your money. Even though budgeting is boring, it has to be done.

Everybody needs a budget.

There is one significant factor that has to be addressed before looking further at the systematic withdrawal plan or the safe withdrawal rate, and that is spending. When you get to retirement, most people have less ability to increase their income. And that ability to increase Income decreases with age. The only way to get the most out of the money that you have is to have a spending plan. Some people call a spending plan a budget. There are a lot of reasons to put off having a budget. Personally, I have gone through all of the excuses for not having a budget. Until you write down your expenses and make a plan to control them, they will control you.

What if you don’t have enough money for retirement?

If you cannot control your spending, you will have a miserable life of never knowing when you will run out of money. Once you get a good understanding of how to control your spending, you can then turn to the task of beginning a systematic withdrawal plan. But what if you don’t have enough money for retirement. At the outset, you only have a few choices:

- Work longer and save more money

- Increase Social Security by delaying taking it

- Live on less money

- Get a higher return on your retirement assets

Making adjustments

So, let’s assume that you have gotten to the point that you have enough money to begin your retirement. To manage a systematic withdrawal plan, you need to make plans when certain events happen. There are only three things that can happen: your amount of money can go up, stay the same, or go down. Those occurrences serve as triggers for your responses. Let’s look at each trigger and discuss what you can do to make adjustments.

- If investment values go up

- Living expenses may be going up, and you need to spend more money.

- You have more money, so you spend more money.

- You could keep your spending the same and save the increase.

- Investment values remain the same

- Living expenses remain the same, so you spend no more money.

- Reduce your spending despite the cost of living going up.

- Investment values go down

- Cut spending

- Draw principle

- Go back to work

The decisions you make of how to spend your retirement savings will be more challenging and vital than your decisions of how you save for retirement. By regular monitoring, a systematic withdrawal plan can give you the best value for your money and help you to have a happy retirement.

To further plan your retirement income, you may find it helpful to consider the income floor approach and the bucketing approach to managing your systematic withdrawal plan.

References

[i] Bengen, William. “Determining Withdrawal Rates Using Historical Data.” Retail Investor. Last modified October 1994. http://www.retailinvestor.org/pdf/Bengen1.pdf.

[ii] Rusoff, Jane W. “Wade Pfau: Coronavirus Tears Up 4% Retirement Rule.” ThinkAdvisor. Last modified April 14, 2020. https://www.thinkadvisor.com/2020/04/14/wade-pfau-virus-crisis-has-slashed-4-rule-nearly-in-half/.

[iii] Littell, David, Jamie P. Hopkins, and Wade D. Pfau. HS 353 Study Outline: Retirement Income Process, Strategies, Ans Solutions. Bryn Mawr, PA: The American College of Financial Services Press, 2018.

Leave a Reply