How to invest a million dollars in the stock market should be no different from investing a hundred thousand, ten thousand, or a thousand dollars. The key is using the KISS method, keep it simple and straightforward.

Three simple questions

Ask yourself these three simple questions. First, what is the purpose of the money? Second, when do you want to have the funds available? Third, how much risk are you willing to take? Let us look at why these three questions are essential. Then we will get into the actual investment strategy.

#1. What is the purpose?

The eventual use of money will affect liquidity. For example, do you want to have it all available at one time? Or do you want to receive the money over time?

How you own investments now and, in the future, will influence the investment strategy too. Also, investing money in a tax-deferred or tax-free account will be different than how you invest money in a taxable account.

The future ownership refers to the eventual inheritance of the stocks. The growth of an investment is not taxed when a person dies. The increase in the value of an asset is called the capital gain. Tax treatment of gains can change with tax law. So, double-check to be sure gains are not taxed at the time of a loved one’s death.

#2. When do you want to have the funds available?

The availability of money has a significant influence on the type of investments you should choose and the mix of investments you hold. Let’s look at two circumstances that happen a lot. Suppose that you want to buy a house next year. Since you know you will spend the money in a short time, you don’t want it to fluctuate in value.

Availability equals liquidity too

It would help if you considered liquidity too. You may like the safety of a one-year treasury note. But you want to buy a house within the next six months. But what if the economy changes within six months? Look at the sudden effect of the coronavirus pandemic. If interest rates go up within six months, the value of bonds purchased six months ago will go down. What that means is if you had to sell a bond, its value would be less than what you paid for it.

How to invest a million dollars and not get sucked in to the wrong investments

No matter what the promises are, don’t get sucked into the hype of any investment. Also, don’t let greed take over your decisions. If you are going to use money in a short time, don’t be greedy. You will read stories of how other people made high returns in a short time. It is very tempting to try to make more money. It’s worth repeating. Don’t get sucked in! If you know you are going to use money in a short time, save it. I’ve seen it happen too many times. Learn to invest money for the time that you intend to use it.

#3. How much risk do you want to take?

Most people want the same thing when investing for their future. They want to have enough, so they don’t have to worry about running out of money. However, how each person gets there is different. How each person perceives risk is unique. But let’s get one thing clear. A loss is a loss, and no one wants a loss. Diversification can reduce and control risk. It can reduce the probability of losses. But the only way to eliminate risk is not to take it.

Risk differs for everybody

For some people, a risk is not necessary. And unless you like the challenge of investing, you may not want to take the risk. Early in my career, I met a lawyer that had a high income. He didn’t need to take a chance with his money because he had such a high income. So he didn’t.

On the other end of the income spectrum, I know a retired teacher who has a teacher’s retirement account. He did not want to take much risks. He had enough income, so he did not need to take a substantial risk. As a result, he diversified with various asset classes. This strategy of asset allocation uses a technique of varying the types of investments. The concept attempts to control risk by holding different kinds of investments. The investments’ value does not move in concert with each other. I’ll talk further about this concept in this article.

How to invest a million dollars with the right amount of risk

To find out what is right for you, look for a risk assessment questionnaire. I have a relatively simple one that I have found helpful. Here is the link to the “Investor Profile Questionnaire.” Or have a conversation with your financial advisor about the amount of risk you are willing to take. I use questionnaires to guide conversations about risk. But I have found that nothing replaces a discussion about what you want and expect. If you’d like to talk to me about de-risking your investments click here to schedule a call to learn more.

Events change people’s preferences

You can change your mind too. Before the coronavirus pandemic, some people were very willing to take investment risk. As the stock market began to fall, their opinion on what was acceptable changed. Having someone that can logically talk through your concerns is so helpful. Financial advisors not only help with what to do when you’re planning. They should be available to talk about what not to do when markets get wild.

Why the amount doesn’t matter.

There is one investment approach that can work, no matter how much money you have. In the not too distant past, the only way to have a diversified portfolio was to buy mutual funds or individual stocks. The variety of mutual funds has changed, but you still are constrained by the design of the mutual fund. Granted, I still use mutual funds and exchange-traded funds to help clients manage their investments. But some people would prefer and benefit from the independence and tax advantages of owning individual stocks.

Cost and constraints are gone

Owning stocks used to be constrained by ownership requirements and trading costs. If you wanted to own stocks, you used to buy whole shares and pay a trading fee or a commission. Those two requirements limited the ability of a small investor to own many stocks.

Under the old requirements, you needed about $385,000 to own the stocks proportionally in the NASDAQ 100. That amount has been drastically reduced for two reasons. Some stock custodians allow investors to buy fractional shares. Plus, the cost for most investors of purchasing shares has been reduced to zero. The only constraint now is the custodian’s minimum account requirements, if any. Plus, to trade at zero cost, most custodians have a basic guideline to follow to avoid the cost of trading.

Controlling the risk of the stock market

Many index funds hold stocks based on the value of the company. That is called market capitalization. Apple, Amazon, Facebook, and Google are tech stocks that dominate the NASDAQ. The companies are so large that when you buy NASDAQ 100 index funds, based on the value of those few giant companies, your investment has an unproportionate value in the tech sector. It is a random approach with no regard for the risk of those stocks.

In recent years, index funds and ETF funds have become popular because of their low cost and simplicity. But one drawback has been the ability to control risk. The selection of stocks is random based on the value of the company.

Categorize first

How to invest a million dollars in the stock market must include categorizing the stocks. The size and valuation of a company influences the risk or volatility of its stock.

A straightforward way to recognize the valuation of a company is to look at Morningstar’s star rating. A one-star rating is overvalued. A three-star rating is fair market value. A five-star rating is significantly undervalued.

A company’s valuation can be a good indicator of its risk. You can categorize stocks by using the overvalued, undervalued, or fairly valued ratings. Overvalued stocks are called growth stocks. Undervalued stocks are called value stocks. I refer to the reasonably valued stocks as GARP or growth at a reasonable price.

For asset allocation, a fourth overall category to include is international stocks. Depending on the stock, it can be classified in one of the three categories also. The uniqueness of global stocks usually prompts investors to lump them together as a separate category regardless of their valuation.

Bonds have a language of their own

Even though bonds are not paying much interest now, it is vital to include bonds as an investment option. Here is the commonsense approach for why investors that want to control risk should consider bonds. They are not stocks!

Remember, the only way to avoid risk at times is not to own it. Bonds are a different asset category that can help an investor control the volatility of their overall investment holdings.

How to invest a million dollars by Controlling Index Risk

Controlling index risk begins by categorizing the stocks. Look at the stocks in the NASDAQ 100. Here are the stock valuations available: Large company growth, large company value, Large company GARP, mid-sized growth, mid-sized value, mid-sized GARP, and international stocks.

How to invest a million dollars using Strategic Asset Allocation

Non-correlating investments are those that do not move lockstep in value when similar investments change value. Allocations reduce risk by non-correlating investment valuations. Take any given day in the market. Unless we have an all-out market correction, there will always be some stocks that go up and some that loose. Suppose in the semiconductor sector that the government imposes a tariff on all semiconductors sold to China. Then all the semiconductors will drop in value because of government policy. Not because of one company’s business results.

Remember, risk and reward are closely related. You will get different levels of risk by combining the assets that do not correlate. Notice I said expect rather than get. The more risk you are willing to take, the more return you should expect.

Using The Modern Portfolio Theory

The blending aspect of the investments I described is a facet of The Modern Portfolio Theory. This theory describes blending assets to obtain the optimal return with the optimal level of risk. The Modern Portfolio Theory was first introduced in 1952 and published in 1959.1 In 1990, the creators of the Modern Portfolio Theory were awarded the Nobel Prize for Economics Science.2

One point that is critical to understand is that sometimes the best-laid plans do not work out. There is always an outlier, something we don’t expect. However, the probabilities of success are better with good planning. If the range of outcomes is clear, investors usually have more comfort with anticipated risk. However, risk can be varied. But the only way to eliminate risk is to avoid it.

How to invest a million dollars in the stock market, really!

You almost have enough information to know how to invest a million dollars or whatever amount you are considering. But it would help if you determined the level of risk you want to have. Not everybody wants the same level of risk. Understanding risk is like diving into a pool. You need to know how deep the pool is before you dive in headfirst. So, we need to logically estimate the limits of risk that exist. And always keep in mind that this is not an exact science. There are no guarantees to the estimates.

I will use two graphs to help describe how dividing assets among logically chosen types of investments can change risk. The change can be either an increase in risk or a decrease in risk. The first graph describes the probability of what the results of investing may be.

Before I get into the technical aspects of this post, I want to let you know that I understand that not everyone wants to learn the details of investing. If you need someone who understands the technical details and can guide you to the investment portfolio that you feel comfortable with then click here to schedule a call to learn more. You and I can spend twenty minutes on the phone discussing your situation and I’ll see if I can help you get the answers you seek. I work on a fee basis and there is no charge for the initial conversation.

Standard Deviation

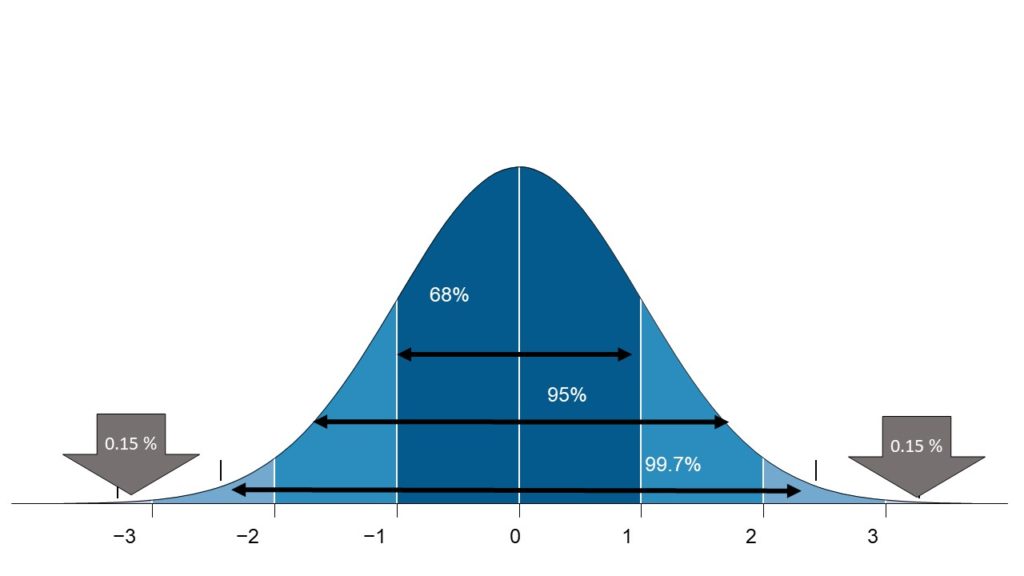

One of the most useful statistics to describe risk is the standard deviation. Standard deviation measures the expected variability in the rate of return of an investment. Look at an investment that has a standard deviation of five. The first thing that standard deviation tells you is that an investment can be 5% over its expected return or 5% under. At this point, most people stop. But this is not all there is to standard deviation.

Investments have a 68% probability of returning one time the standard deviation over top of or under the expected return. Many people miss this part.

An investment has a 95% probability of returning two times the standard deviation over top of or under the expected return. In other words, 95% of the time, the investment could be 10% over or 10% under the expected return. Furthermore, 99.7% of the time, an investment could be three times the standard deviation over top of or under the expected return. You probably have it by now. The investment would be 15% over top of or under the expected return. 99.7% of the time. Then there is the outlier of 0.30% where anything can happen.

Another way to look at this set of probabilities is to subtract one set from the other for more specific definitions. For example, two standard deviations or 10% up or down should occur 27% of the time. You get 27% by subtracting 68% from 95%. Then three standard deviation occurs 4.7% of the time. You get that result by subtracting 95% from 99.7%. Then the outliers result in .3% of the time.

Here is an important lesson that life has taught me. Never let low probabilities lure you into a sense where you say, the possibilities are so low that it will never happen to me. Because life happens at the most unexpected times, plus, if you live long enough, at some point, the odds will NOT be in your favor.

How to invest a million dollars using standard deviation

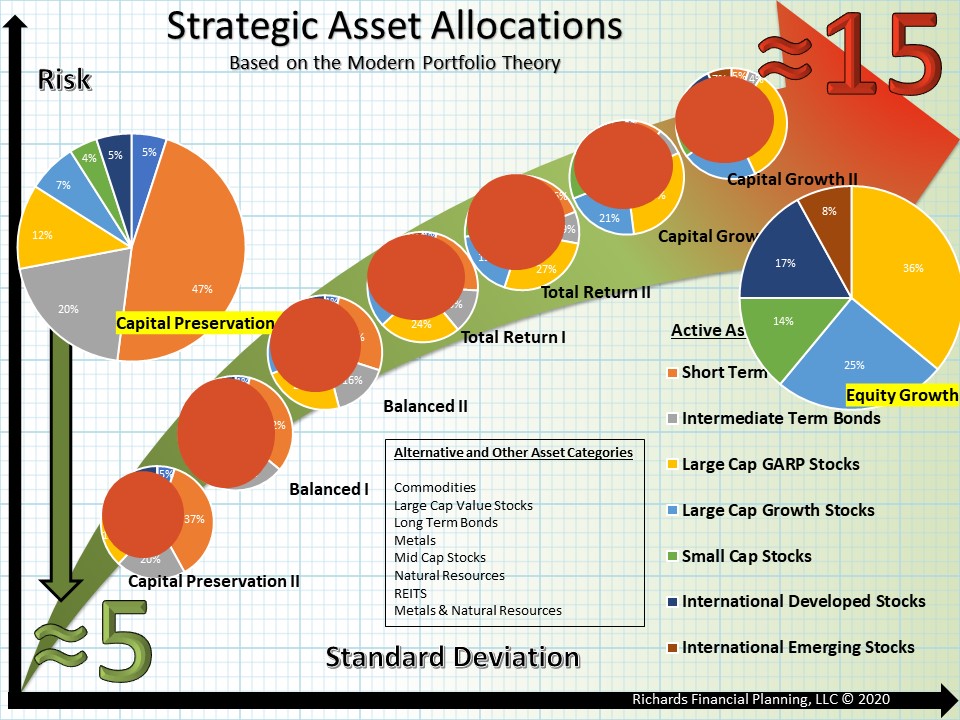

One way to use standard deviation is to understand the possible outcomes of different investment allocations. Let’s look at the primary example used in the beginning. Start with low risk and high-risk investments. To make the model more specific, give the low-risk investment a standard deviation of five. And provide the high-risk investment a standard deviation of fifteen.

You will get different levels of risk by combining high and low-risk investments. The standard deviation for each allocation will fall between five and fifteen.

It is important to remember this fact. The only way to eliminate risk is not to invest. But if you are willing to accept the risk, strategic asset allocation can help you control the level of risk you take.

Finally, we are here!

Here are the models that show how to invest a million dollars, or whatever amount you have in mind. The last graph shows nine of the possible strategic asset allocation models that I use to create investment plans for clients. I am only going to use two, the most aggressive and the least aggressive.

Some of the asset categories are omitted from the two models too. These are investment categories that are either too risky or lack the risk/reward some investors seek. The models are a starting point for constructing an investment strategy.

You can see how risk is further controlled by the change in percentage of some asset categories. Large-cap growth stocks are a great example. In the conservative model, large-cap growth stocks represent seven percent of the allocation. In the aggressive model, large-cap growth stocks represent 25% of the model.

Choosing stocks to fit the model

Over about two months, I reviewed every stock in the NASDAQ 100. I broke down three critical aspects of each stock, earnings, competitiveness, and stability. The stability aspect is the valuation, and it is derived as a result of earnings. I determine if a stock is a value, growth, or GARP stock. GARP is growth at a reasonable price. I also consider if it is a domestic company or foreign.

The information I cover every day can determine which stocks should go into which allocation of the models. I don’t talk a lot about bonds because the focus of my daily livestream is NASDAQ stocks. But, bond investments are an essential part of stock market investing, especially for conservative investors.

Review regularly

Once you learn how to invest a million dollars, should you forget it? If you had a million dollars in an account, would you ignore it? Probably not. You should review your investment holdings at least annually. Depending on your strategy, you may want to review your investments quarterly. There are three criteria that I focus on to determine if a company will be included in the model:

- Company earnings. Are the earnings rising? Are they producing at or above estimated earnings consistently?

- Competitiveness compared to similar companies

- Stability, which is described as a company’s moat. A moat in investment analysis is the imaginary barrier between the company and its competitors. What business traits keep competitors from at bay?

There are other factors, but unless a company has good earnings, they’re competitive and stable, they are not a good investment.

You don’t have to go it alone

Here is one of the most essential pieces of advice I can give you. Never invest in something that makes you lose sleep every night over. It is natural to be concerned when the market is in chaos. That is an excellent time to have someone to call that can offer you guidance. But if you lose sleep every night over your investments, then the investments you have chosen are too risky. Either commit to learning more about the investments you have or change to a more conservative investment strategy. Good luck, and don’t hesitate to reach out to me if you have questions about investing or retirement planning. I’m here to help. If you’d like to talk click here to schedule a call to learn more.

Please remember that investing does involve the risk of losing value. Plus, the past performance of an investment is not a guarantee of its future results. This information is not a personal recommendation. Van Richards, Richards Financial Planning, LLC, associates, or affiliates assume no risk for the success or accurancy of this information.

References

1 Markowitz, H. “Portfolio selection – efficient diversification of investments.” Cowles Foundation for Research in Economics. Last modified 1959. https://cowles.yale.edu/sites/default/files/files/pub/mon/m16-all.pdf.

2 The Royal Swedish Academy of Sciences. The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 1990. Stockholm, Sweden, 1990. https://www.nobelprize.org/prizes/economic-sciences/1990/press-release/.

Leave a Reply