I’ll have to admit that sometimes I miss the subtleties of conversations. Like this past weekend, I was washing my Tahoe, and my neighbor had a power outage. The repairman walked by me and said, “are you trying to make it rain?”

I guess I was engrossed in some other thought, but I just nodded and said, “yes.”

It took me a minute to get what he said. And if you’re like me, you got what he meant a moment later. He meant that every time you wash your car, it seems to rain. I wanted to run and catch him and say, “I get it now!” But I didn’t want to look like Forest Gump.

Call it ADHD or whatever you want, but there are times when common things seem to go past people. Please make me feel better by agreeing that I’m not the only one (I’m making a sad face now). Oh good! You agree, now I feel better.

There is a very common phrase in the world of finance and retirement planning that I think goes over people’s heads a lot. Have you ever heard the phrase “tax torpedo?” Some financial planners may say, “you have to be careful when you retire not to get hit by the tax torpedo!”.

A tax torpedo? That sounds really bad. It’s taxes, which everybody hates. And a torpedo, which is going to blow up. So, of course, nobody wants to get hit by the “tax torpedo.”

If you have heard this and really don’t get it, don’t feel bad. I think a good number of financial advisors don’t fully understand it, either.

The good news is that I’m here to SIMPLY explain it, and I do mean simply. So here goes.

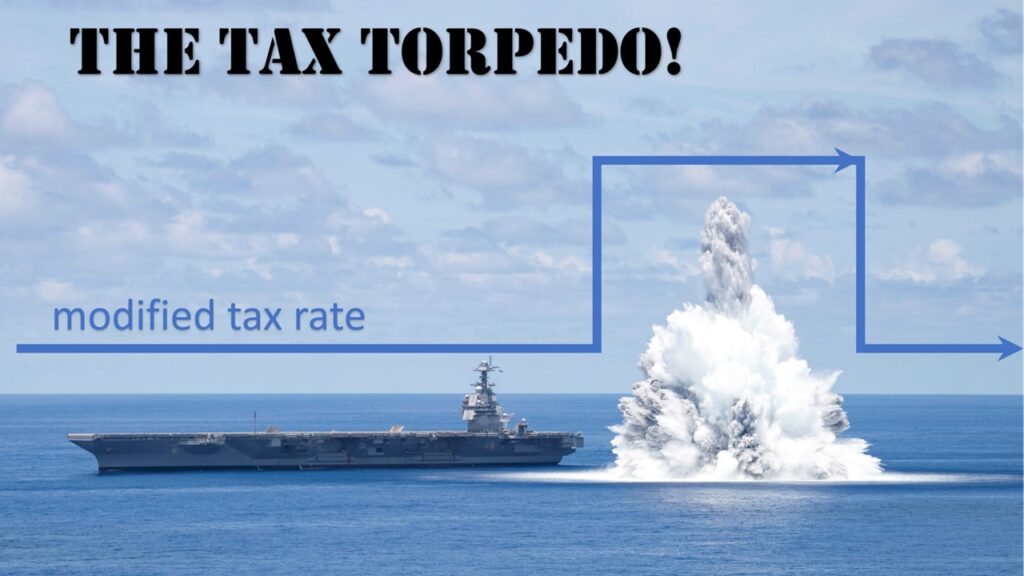

Do you know the big explosion that happens in the water when a torpedo explodes? It makes a big splash and then the water settles down quickly. If you drew a line along the path of the torpedo and then continued that line, it would have a big hump where the explosion occurred.

Here’s the connection to taxes when you retire. When you start to receive Social Security retirement income, you receive it tax-free until you get to certain limits. There’s a calculation for that, but I’m going to skip that for now.

When you get to the first limit, you start to have 50% of your Social Security retirement income taxed. When you get to the second limit, you then pay tax on 85% of your Social Security retirement income.

If you drew a graph to represent your income and taxes due, there would be a big hump between the first- and second-income limits. In other words, your modified tax rates sharply rise, then fall.

The shape of the graph is similar to the shape of the graph of the torpedo when it explodes. Here’s a picture of what I am referring to.

The tax torpedo is something that will happen to a lot of people when they retire, mainly middle-class workers. There are things you can do to either avoid the sharp increase in taxes or reduce the effect. Some steps can be taken in retirement, and others must be done when you are younger. So here are the solutions.

1. Delay taking Social Security

2. Delay retirement

3. Delay taking taxable income

4. Take income from sources that will not be included in your “combined income,” like

a. Life insurance loans

b. Income from a reverse mortgage

c. Roth IRA distributions

d. HSA distributions

e. Personal savings distributions (careful that gains don’t trigger income)

When you get to retirement, you need to do tax planning. FYI, your tax software, like TurboTax, is not going to help with this problem. There are some online resources. Here’s an excellent article by Dr. William Reichenstein, author and emeritus professor of finance at Baylor University: Understanding the Tax Torpedo and Its Implications for Various Retirees. I’ll forewarn you that the article does get technical.

On the other hand, if you need guidance, look for a good financial advisor that can act as a fiduciary for you. Request that they create a plan that will show you the impact of taxes on your Social Security income. Then ask them what steps you can take to reduce or avoid that tax.

As always, I must point out that this is friendly educational information. This is not personal financial or investment advice.

I hope this has given you some information you can use.

Have a great week,

Van

Leave a Reply