Are you ready for what’s coming?

We don’t go through actual bear markets that often, so the more you know about bear markets, the better you will be able to make informed investment decisions. After all, the overwhelming chaos in the world investment markets makes even the most experienced investors second guess themselves. I want to help you look forward by looking back at ten historical patterns. Remember, we are looking at the past to give perspective. But before we do that, remember this piece of sage information. The past performance of an investment is not a guarantee of its future results. With that, here are the points to keep in mind.

Watch for 20%

1. The 20% benchmark is a 20th-century reference. But English writer, Daniel Defoe led us to infamously refer to a losing market as a bear market. Markets enter a bear market when the closing price declines by at least 20% from its most recent high. Cycles are measured from peak to trough. A market correction is a drop of 10%-19.9%. Conversely, a new bull market begins when the closing price gains 20% from its low.

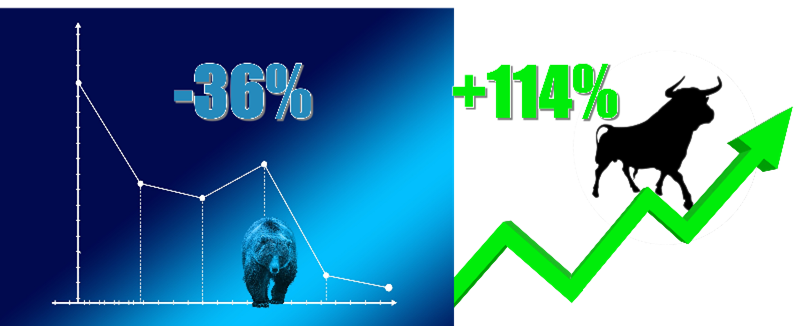

Stocks lose 36% on average in a bear market.

2. By contrast, stocks gain 114% on average during a bull market. After all, bear markets are a normal part of the investment cycle.

26 down vs 27 up

3. There have been 26 bear markets in the S&P 500 Index since 1928. In contrast, there have also been 27 bull markets—and stocks have risen significantly over the long term.

They’re short-lived

4. 289 days is the average bear market. Then again, the average bull market is 991 days. But, this market environment may be different from any other. For example, low employment may not be the driving factor. Only time will tell.

Every 3.6 years

5. That’s the long-term average frequency between bear markets. However, many consider the bull market that ended in 2020 the longest on record. Then again, the bull market that ran from December 1987 until the dot-com crash in March 2000 is technically the longest.

Consider frequency

6. Bear markets have been less frequent since World War II. For example, between 1928 and 1945, there were 12 bear markets, about every 1.4 years. Since 1945, there have been 14—one about every 5.4 years.

The best days are in the worst of times

7. Here’s a point to remember. In the past 20 years, half of the S&P 500 Index’s best days were in a bear market. The first 2 months of a bull market accounted for 34% of the market’s top days. This was before it was clear that a bull market started.

It might not be…

8. Bear markets don’t necessarily mean a recession. There have been 26 bear markets vs. 15 recessions since 1929. Bear markets often go hand-in-hand with a slowing economy. Declining markets don’t necessarily mean a recession. By the end of July, we’ll know.

You will see many

9. Assuming a 50-year time horizon, you can expect to live through about 14 bear markets. Yet it is stomach-churning to watch your investments fall. Even though there are no guarantees, keep in mind that downturns have always been a temporary part of the process.

The pain and the gain

10. Bear markets can be painful. But overall, markets are positive most of the time. In the last 92 years of market history, bear markets have comprised only about 20.6 of those years. Put another way; stocks have been rising 78% of the time.

The year is half over, and the path forward for the markets is a big mystery. Additionally, many economists are spouting what they think will happen for the remainder of this year. But you don’t have to be an economist to have an opinion about what’s next. Use your own intuition. The moral of this story: Long-term investors benefit by establishing goals, setting parameters or guardrails within their investment planning, adjusting when needed, and sticking to a plan.

I hope this information has helped you grow your knowledge so you can better control your financial future. This information is for educational purposes only. It is not investment advice. If this information was helpful to you, share it with a friend. For more information on investment and retirement planning visit my blog at https://richardsfinancialplanning.com/blog/

Best regards,

Van Richards, ChFC®

Leave a Reply