If you are like a lot of other people, you are probably asking yourself, does asset allocation still work? You probably began your investment journey when your employer offered you a retirement plan. More than likely, your employer-provided some basic information about how to divide up your retirement plan contributions. That is asset allocation.

But with all that is happening in the world, you may be asking yourself, does asset allocation still work? Is how you divided your investments doing what it should?

First, let’s talk about why people divide their investments in the first place. I learned a long time ago that dividing your investments is like collecting eggs in a basket. If you drop one basket, you will not break all your eggs. So, dividing your assets can help you reduce the possibility of total loss.

While that old analogy is still true, our objective in asset allocation is not only to reduce the general effect of a loss. But asset allocation is used to affect how much your overall value fluctuates. Simply put, asset allocation is spreading investments in a way so that all investments do not move to the same degree. The primary reason people use asset allocation is to control the risk of investing.

Before I get too far into today’s topic, I want to tell you about a free tool that I have for you. I know that some of you love the details about investing, but I also know many of you just want to see the examples of how you can invest your assets now. And you’ll figure out the details later. So rather than wait until the end to give you the investment models, I’ll jump right in and give that to you now.

If you want to see the asset allocation models from today’s show, go to a special website I created for this show, and you can download them now. Go to www.assetallocationmodels.com, and you can download those models for free right now. OK, let’s get back to discussing IF asset allocation still works in 2023.

What’s causing you to worry?

What would you say if I asked you, “what is causing you to worry about your investments?” Of course, you may say the war in Ukraine, the pandemic, inflation, or the myriad of other things happening around the world. But when you get to the root of any investment anxiety you have, it is this.

As of late, the investment markets have been bouncing around a lot more than normal. And anytime you lose value, that is bound to cause some anxiety. But if you are worrying more than usual, you may be thinking about the problems the market volatility could cause in your life.

What could that mean to you? The closer we get to using our investments, the more we tend to be concerned about our investment value. In other words, if you lose value, you might need to delay retirement. Or, if the value drops, you might not be able to pay for future medical expenses. Anxiety over any of these issues may cause you to ask yourself if you are doing the right thing. And when it is related to your investments, many of you ask yourself, does asset allocation still work in 2023.

And the answer to the question, does asset allocation still work in 2023 is yes. But that affirmation needs to be qualified. Yes, it still works if it is done right.

To explain what I mean, let me give you an example of asset allocation done wrong. Early in my career, I had a client that came to me with fourteen mutual funds from different companies. And most of them were mutual funds with similar investments in large companies. That was not asset allocation.

I want to introduce you to some of the asset classes that I use and others that are available, but let’s be clear on why investors should consider spreading their investments among different asset classes.

People use a variety of asset classes so that all their investment value does not move to the same degree.

Asset classes that are considered conservative will move very little in good or bad times.

On the other hand, some of these asset classes that are invested in aggressive companies will move a lot during good or bad times.

By mixing the different asset classes, the intent is to have an investment mix that satisfies your risk tolerance.

But I want to be clear about the following statement. NO investment is isolated from the risk of loss of value.

That is so important that I want to repeat it. All investments have the potential for loss of value. There are no guarantees. With the probability of gain also comes the probability of loss.

And probabilities are how I describe the usefulness of asset allocation, which is why asset allocation still does work in 2023.

Geek Alert! What’s Standard Deviation?

Not to get too geeky, but to understand how helpful asset allocation is, you need to understand an important investment term, standard deviation.

Standard deviation is the probability of loss or gain. Let me give you an example.

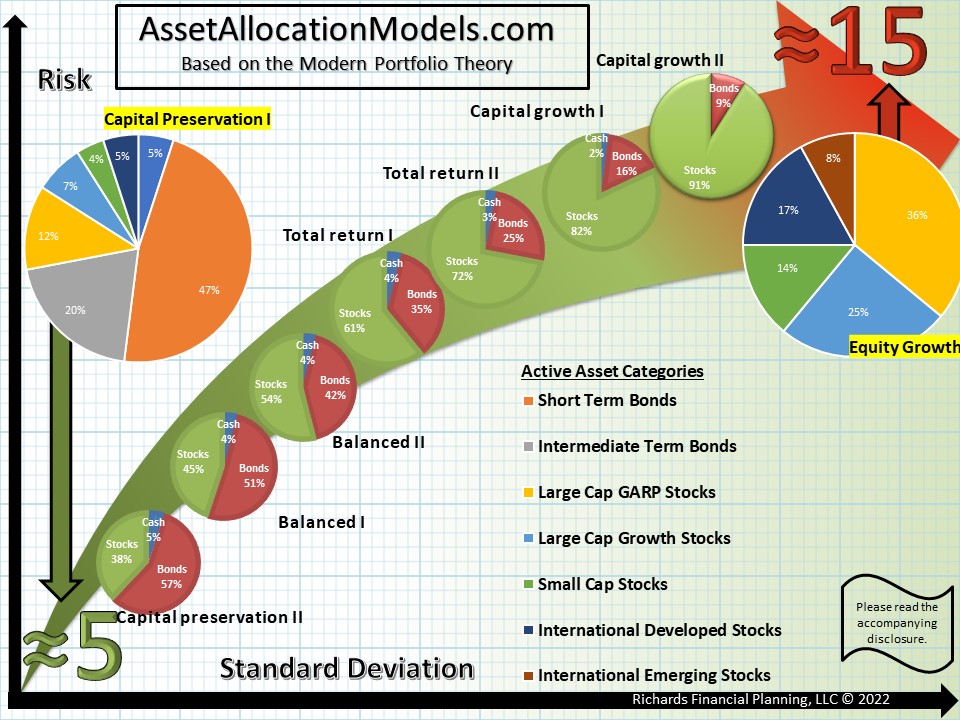

In a very general sense, my most conservative asset allocation has a two-thirds chance of being up or down 5% at any time. That means that the conservative asset allocation has a standard deviation of ± 5%.

But it is essential to understand that there are outliers. That is to say that there are possible outcomes that lie far outside the normal range. But they are still possibilities. For example, the outlier for the standard deviation of ± 5% is that about one-third of the time investment returns can be outside of the 5% goal. In other words, it can be better, but it can be worse too.

For the most aggressive asset allocation, the standard deviation is ± 15%. So, in this instance, the asset allocation has a probability of being up or down 15% two-thirds of the time. And the outlier is that one-third of the time, the investment performance can be better, or it can be worse. Of course, everybody is always happy with the better aspect, but it is important to keep the worst-case scenario in mind.

All investments have risks.

With this in mind, you can see that there is no investment without risk. So if you want to avoid the risk of investing, don’t invest.

The concept of standard deviation is fundamental to understanding the value of asset allocation. So, if you are a little confused, rewind this recording and listen to this section again.

Accordingly, if you want to limit your risk, use asset allocation. Conversely, if you want to eliminate risk, don’t invest.

Investment classes or categories

I am not recommending specific investments or allocation, but I want to educate you on how using different asset types may limit risk.

Now, I use seven different types of assets:

- Short Term Bonds

- Intermediate Bonds

- Large Cap GARP Stocks

- Large Cap Growth Stocks

- Small Cap Stocks

- International Developed Stocks

- International Emerging Stocks

You might not see the term GARP in item number three too often. So let me explain that a little bit. I use the term GARP, which means growth at a reasonable price. It is the concept of investing in value stocks, but with some perimeters. In some circumstances, I don’t focus on the term value because it brings in deeply discounted stocks that have some fundamental reason why their value is so cheap. In this case, I am not looking for cheap stocks. I am looking for stocks that are discounted but offer growth at a reasonable price.

Now there are lots of other types of asset categories like

- Collectibles

- Commodities

- Cryptocurrency

- Derivatives

- Large Cap Value Stocks

- Long Term Bonds

- Metals

- Mid Cap Stocks

- Natural Resources

- Options

- REITS

- Metals & Natural Resources

The list of other asset categories is almost endless. And no asset category is best all of the time.

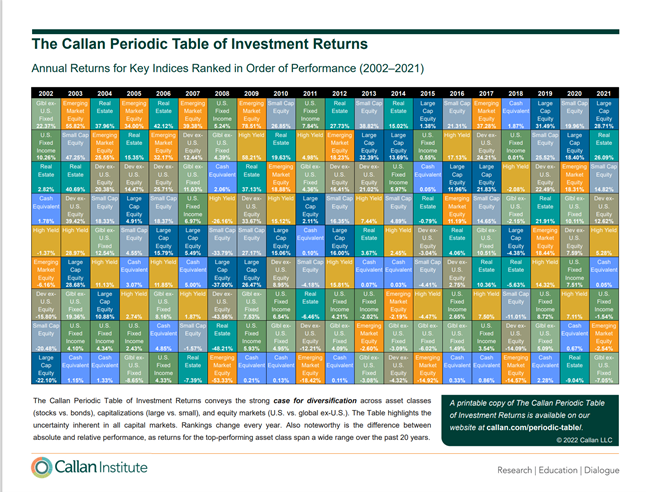

The Callan Periodic Table of Investment Returns

And to show you that no asset category is the best, I want to show you research from The Callan Institute. This chart is called the Callan Periodic Table of Investment Returns.

This chart shows the best and worst-performing asset classes from 2002 through 2021. Here is the major takeaway from this research. At no time during that time between 2002 and 2021 was the same asset class, the best performing asset class two times in a row. But there were years where some asset classes repeatedly were bottom performers.

Callan uses eight asset classes, which is slightly different from my approach. But the asset classes are very similar. You can see the second page that describes the asset classes through the link to their website.

Since no one asset class dominates the top from year to year, but some asset classes are poor repeat performers, it is crucial to use asset allocation and diversify among asset classes to control risk.

What are some uses for the asset classes?

Knowing that there are asset classes is only the beginning. The next step is allocating investments among the asset classes to change the level of risk or exposure to market volatility.

I have reduced the seven asset classes that I use to three: cash, stock, and bonds to make this easier to understand. Then I’ll give you two more specific examples of how I use asset allocation to narrow or expand the probabilities of investment returns.

The overall emphasis of asset allocation is this point. The more bonds you have, the more conservative your asset allocation is. And conversely, the more stocks you have, the more aggressive your asset allocation is. So to that point, you’ll see in the example that the Equity Growth Asset Allocation is 100% stocks.

If you look at the list of asset categories, it lists the conservative to aggressive categories from top to bottom.

As I mentioned at the beginning, if you want to see the details of the asset categories for each allocation, go to assetallocationmodels.com, and I have a free pdf that you can download with all of the asset allocation details for each model.

There are times with nothing works

Now there is something essential for you to know. And I want to tell you about this significant point by sharing a quote from one of my favorite poets, Robert Burns. Robert Burns wrote the poem

“To A Mouse.” And one of the most famous phrases from that poem is “The best laid schemes o’ Mice an’ Men Gang aft agley.” Or more commonly heard as the best laid plans of mice and men may go astray.

So plan as we may with asset allocation; sometimes those outliers take over, and nothing works. We saw it happen in the stock market at the beginning of the pandemic. The world was in a panic, and almost all investments dropped.

But there are ways to plan for those times, but that is a topic for another day.

I hope this information has helped you grow your financial knowledge. Because the more you can grow your financial knowledge, the more in control you will be of your financial future.

Please be sure to read the disclosure below. Have a great day.

Leave a Reply