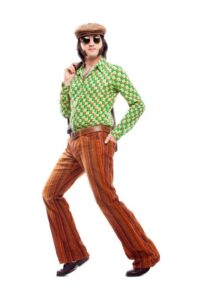

A Blast from the Past!

Reviving retro fashion trends is popular but could reviving the past trend of the 60/40 portfolio be on the comeback too? I used to have bell-bottom pants. How about you? I remember being fourteen and getting bell-bottom pants and platform shoes for Christmas. Thank God there are no pictures!

Retro fashion trends may be popular, but what about retro investment trends like the 60/40 portfolio? Is it time to bring both back? If you’re unfamiliar with the 60/40 portfolio, it refers to a once-popular investment strategy. A 60/40 portfolio is an investment allocation of sixty percent in stocks and 40 percent in bonds.

While some investors are embracing the idea, plenty of naysayers still believe that this strategy is dead. But wait! You may say I always kept my allocation the same. So when was it ever dead?

Some people never change.

I know some people always keep their investments the same. And you know what? If it’s working for you, why change? Unfortunately, a big problem with many people’s investment strategies is that they change far too often. You’ve probably heard the saying, “the secret to investing is time in the market, not timing the market?” I agree!

The 60/40 portfolio strategy still offers a good option to those saving for retirement as well as to those that are in retirement. Now, you have to understand that as I am writing this to you, I am not talking specifically about you.

Four reasons the 60/40 portfolio still makes sense.

Today, I want to give you four reasons the 60/40 portfolio still makes sense for some investors. You have to decide if you are one of those investors. On the other hand, the 60/40 portfolio allocation is only one type of many investment models that can manage the risk of investing. Here is a sample of the kind of investment models I use in my financial planning practice: www.assetallocationmodels.com

Given that, let’s look at four top reasons why the 60/40 portfolio may not be dead.

Reason #1

It changes the market risk.

It’s a type of diversification that changes market risk. The 60/40 portfolio intends to generate market returns while altering the risk of investing in one asset class. For example, some think it reduces the risk of only investing in stocks. In some years, that is true, but not all years.

The strategy is considered a retro investment strategy because its popularity dates back to the 70s. While bell-bottom pants were in their heyday, Vanguard founder Jack Bogle was popularizing the idea of the 60/40 portfolio. But did he start it?

In reality, it’s one of those familiar concepts like the phrase “barking up the wrong tree.” No one knows who first started using it. But it’s been around for a long time.

Reason #2

It can help with automating your finances.

From reading my letters in the past, you might remember that I am a fan of financial automation. As I have said, as you age, automating your finances will help you better cope with the risk of retirement.

There are six risks that you will face when you retire:

- Risk of going broke

- Risk of not working

- Risk of getting older

- Risk of investments

- Risk of government change

- Risk of family dilemmas

Let’s look at a straightforward example of automation.

Automating monthly bills can help you manage your budget and possibly avoid going broke. It can help you manage the mental decline of getting older so you don’t forget to pay bills. When it comes to investments automating any income you have prevents you from having to make bank deposits.

I had that happen once. I had a client’s son call me and tell me that his mother was losing her dividend checks. So in that client’s circumstance, automating payments and deposits helped lessen the risk of getting older and family dilemmas.

On the whole, automating monthly bills helps you take less time managing an essential part of your life. And we are all striving to get more control over our time.

However, I’ll give you a word of caution on automating bills. Monitor what is going out of your accounts monthly. I had an electricity bill that jumped from about $400 a month to $800 this past summer. When rates jump like that, you will be in for a surprise deduction from your account. If you know it’s coming, you can make arrangements for that type of bill.

60/40 portfolio and automation

The 60/40 portfolio could have individual stocks and bonds. Or it could be invested in funds like mutual funds or ETFs. If you are using individual stocks and bonds, it will take more effort to manage your investments. On the other hand, if you use funds like mutual funds or ETFs, you could set the allocation and leave it alone or allow the funds to rebalance to the 60/40 portfolio allocation within preset guidelines automatically. All in all, the 60/40 portfolio offers investors a great way to manage the risk of investing by automating the distribution of assets.

Reason #3

Consecutive negative years don’t happen often, but…

While this may be true, I will say something that may surprise you. Don’t discount the possibility of another down year for stocks in 2023…maybe. Some might think that since stocks were down one year, they’ll come back the following year. However, that is the wrong reason to use a 60/40 portfolio strategy.

The reason for using any diversified asset allocation model is that you are comfortable with the long-term outcome of investing in a combination of stocks and bonds. With this in mind, if you use that type of investment strategy, you must personally weigh the risk. And then arrive at the conclusion that you are comfortable with the risk. In short, don’t make assumptions based on historical results. The 60/40 portfolio may not be dead, but it still has risk.

Reason #4

Income and dividends can make a difference.

In considering any investment strategy, you must realize that you cannot eliminate market risk. However, you can alter the market risk by diversifying your investments.

I may sound hostile toward investments, which might seem a little weird for someone who helps clients manage investment strategies. But my point is that investing is not for everybody. And most of the propaganda you see is trying to get you to look at investing with rose-colored glasses. I am not writing to do that. On the contrary, my point is to improve your knowledge so you can make better financial decisions. Keep this in mind, if you’re interested in investing, be sure you are patient. Invest within the level of risk that you are most comfortable with. And be sure to understand the downside, not just the upside.

Being that, my point here is that the 60/40 portfolio offers investors the opportunity to alter market risk by using stocks and bonds that pay dividends. Income from these two asset classes is different from investing only to see an appreciation in the market value of the asset.

Look at stock dividends.

For example, consider the environment for dividend-paying stocks. Let’s look at what happened with stock dividends for two different time periods. On the negative side, in the 2010s, dividends accounted for a mere 16% of the total return for the S&P 500 Index. On the positive side, from January 1, 1926, to November 30, 2022, dividends contributed an average of 38% of S&P 500 performance. And in the inflationary 1970s, dividends from S&P 500 stocks climbed to account for more than 70% of market performance.

While this may be true, you may ask yourself how the current high inflation environment will affect stock dividends. The answer to that question is full of possibilities and risks. And every investor must make their own decision.

The case for bond income.

On the other hand, bond rates are higher than they have been in years. While it is true that raising rates do drive down existing bond values, current income from bonds is another way to alter the market risk of investing.

While reviving retro fashion may be more fickle, these four reasons give some investors the incentive to believe that the 60/40 portfolio is still alive.

As always, to end today, remember that this information is for educational purposes only. This information is not investment, accounting, or tax advice. For those things, you need to find yourself a good fiduciary advisor. 😉

Have a great week,

Van

PS, here are some other great topics from my blog that may interest you.

Leave a Reply